~9 EV/OCF AI Company Growing Revenue 75%+ YoY ($ALAR)

Alarum is an extremely undervalued beneficiary of major AI tailwinds and enterprise needs for fresh web data.

Alarum, Safe-T Group, and NetNut

Alarum was founded in 2014 as a cybersecurity focused company called Safe-T; until 2023 it traded under SFET 0.00%↑. As of 2023 it has scaled down/sold off cyber security assets, distanced itself by changing its name to Alarum, and focused on its web scraping/proxy network segment. The company now operates a network of 52+ million residential proxies which enable it to provide enterprise web-scraping services, allowing a variety of web-based industries to make data-driven decisions and fuel their AI-driven products.

Headquartered in Israel, and led by founder Shachar Daniel, Alarum focuses on three product lines, but this writeup focuses on NetNut, is its proxy/web scraping division (and its growth engine). By offering an API integration that allows developers to utilize proxy server networks in-program, NetNut charges on a per-use basis. This service is invaluable for enterprises scraping large amounts of web data both for general business purposes and for training LLM models.

Management has reoriented the company to a sector in which it has a significant moat, brand equity, and a track record of success. NetNut is a scaling incumbent, with a well-regarded brand name, and is a picks-and-shovels business enjoying significant tailwinds from AI-driven data demand.

Alarum is growing revenues at 75% YoY and generating a significant amount of operating cash. The market is not pricing it fairly due to a lack of public comps, misinformation about the legality of web scraping and Alarum’s moat, and the company’s general obscurity and convoluted story.

There is a clear path to 100% upside over the next year through market familiarity and revenue expansion.

Product

Imagine you work at an airline and are doing competitor research on ticket prices. If you simply Google prices and try to compile them, you’ll run into several problems.

This is an arduous task to do manually, so you will have to use a script.

Your script needs to coordinate a complex series of VPNs to conduct research across geographies, because ticket prices change based on location.

Your proxies will need to be from legitimate IPs and utilized smartly to avoid anti-bot software (think Cloudflare), firewalls, and rate limits.

Obviously setting this up would be a terrible ordeal. Alternatively, you look to a company like NetNut. There are similar examples across a variety of businesses with web presence:

Thousands of corporations have a need for this sort of service and constantly utilize such services. To truly grasp the size of this market, note that a larger market data scraping company, BrightData made 5.5 trillion calls last year [Source]. This is 2x the volume of search engine queries.

Financial Performance

Over the past 5 years, Alarum has generated a 78% Revenue CAGR while keeping strong margins of around 73%. The reason for lower margins than other software companies is predominantly due to Alarum’s sales team, since most of their profits come from enterprise sales.

Historically, the company has not appeared on many screeners as profitable due to the fact that the company recently sold off its CyberKick division to focus on its proxy business. This resulted in a one-time write down of intangible assets of around $9M. However in ‘23 the company generated $3m of profits, and without this writedown, would have generated substantially more.

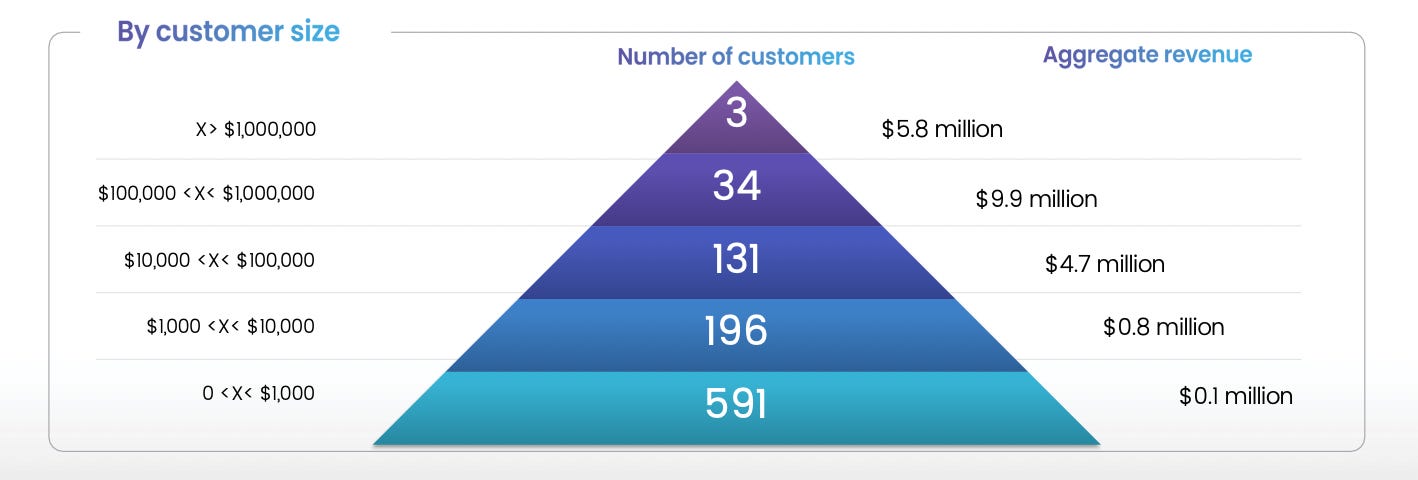

Management has spoken to its confidence that it can maintain its operating margins without acquisitions or investment in the sales team. It is seeing 150% revenue retention YoY, meaning that current customers are renewing and spending even more. Customers are diversified across spending levels, and a large base of paying customers that spend less than $10k yearly gives a funnel into mutual growth and higher proxy spend:

More generally, the data scraping market (which also includes labeling and categorization services) is expected to expand at a CAGR of 28.9% from 2023 to 2030 to reach $17.1B, driven largely by AI tailwinds.

This should only accelerate. How many times have you been annoyed by Chat-GPT surfacing stale data? LLMs all need to be fueled by and incorporate recent data, and this data generation is completely dependent on web scraping. If you are bullish on AI and LLMs, consider that NetNut and Alarum are positioned to continue capturing market share in a burgeoning field.

While not included in the basis of the below valuation, the company has developed two products which should further increase revenues and revenue retention in the coming year:

SERP (Search Engine Results Page) Scraper: This allows customers to pull data from the results of searches rather than from distinct websites

Web Unblocker: This allows the company to scrape data from websites which attempt to limit data scraping by scraping in ways which do not trigger anti-bot defenses

These products make the company more competitive with larger players for new clients and help them upsell current clients. Management comments that 2024 will involve building out these products with the existing client base and expects significant revenue impact in 2025.

Valuation

Last quarter’s OCF was $2.7M. Assuming no acceleration, which is unlikely, 2024E OCF is around $10.8m, giving a lower bound EV/OCF multiple of 10.9x. However, the first two months of 2024 have shown an increase in OCF of $2.5M (backing out the exercise of $800K of private placement warrants). Straightlining, we would have 2024E OCF of ~$14M, for a multiple of 8.5x. There are no direct public peers, but most growing smallcap software companies trade at a median EV/OCF 20–30x. Alarum is growing revenue at a 70% CAGR, which these peer companies are not.

From a precedent transactions perspective, BrightData was acquired at 5x then-revenues in 2017 for $200m. This was well before LLMs were widely in use, and before AI tailwinds truly began. BrightData is currently at $100m revenues—speaking to the growth of these proxy companies—and would command a much higher multiple today. If we forecast $40M just straightlining historical growth (conservative based on management comms), and assume the stale historical multiple, there is still ~75% upside.

While one might think the company would be tempted to dilute shareholders to scale its sales team and fuel growth, the company believes that its cash generation is enough to cover scaling. On the last conference call, the CEO Shachar Daniel said the following:

“So first of all, you know, if you measure our operating expenses as a percentage of the revenues, basically our plan is to stay [at] the same rate. As I can tell you now in the first quarter, as we see the growth and basically we stabilize our team and our operating expenses. So I don't think that there is a time in the near future that you will see that I may identify as a point that we need to increase shapely or to invest significant investments in our operation in order to support the revenues.”

Additionally, management indicated that they had not refiled their expired F-3 prospectus as they did not indicate a need to raise money in the foreseeable future.

Management

Alarum’s CEO is Shachar Daniel, who co-founded the company in 2014. I wish there was more information on Shachar as he relates to Alarum available online—most of his interviews deal with Safe-T group, which focused on cybersecurity and was rebranded to Alarum as the company pivoted. From what I have seen and from his performance on calls he is a competent and driven operator.

Management has a decent stake in the company of around 6m shares on total diluted share count of around 40,000,000. Given the market cap has grown from $13m as of last March, and that shares are quite illiquid, it’s understandable that management has not simply been able to accrue a massive stake.

Management has shown a willingness to make significant insider purchases however, and many of its shares attribute to a $1m private placement last September. I would note this has not yet been reflected in ownership metrics on Bloomberg:

Factoring employee shares and restricted units, company insiders own around 20% of the fully diluted shares, which is significant for an illiquid stock which until recently had a much lower market cap.

Why is it cheap?

Alarum is an obscure company with no analyst coverage. Further complicating the story is the fact that the company is headquartered in Israel (so is BrightData, for the record). Previously it traded as Safe-T group before the pivot away from cybersecurity, and this change further obfuscates the current promise of the company.

Equity screeners would not surface the company as profitable, due to the 2023 writedown of CyberKick, meaning that many simply have not considered it. Further, the Bloomberg list of insider ownership does not account for the aforementioned private placement, demonstrating the obscurity of the name.

Alarum is a microcap and has only recently crashed the “$100m threshold” where institutions typically become more interested in public companies. Additionally it's also the case that many investors may look at the company’s rapid share price appreciation and discount it as purely hyped based. They may see the company as a ChatGPT wrapper, rather than the picks-and-shovels business it truly is.

The largest reason for the discount to other fast growing tech companies is concern over the company’s moat and the legality of web scraping. These concerns are misplaced, but bear discussion in their own sections.

Moat

One may be tempted to think that the web-scraping/proxy market will become commodified, but in reality, this couldn’t be further from the truth. To set up a residential proxy network, it’s necessary to onboard millions of people, negotiate with and abide by the requirements of IP networks. Further, you must actively get them to agree to install your dev kit on their device, generally in return for discounted access to the proxy network or some other compensation.

The marketplace has several main players: BrightData (72m+ IPs), Oxylabs (100m+ IPs) and SmartProxy (40m+ IPs). There are few other significant players. NetNut is likely to be one of these major players unless new entrants can convince tens of millions of people to install their SDKs.

Additionally, when selecting a proxy service, enterprises have to go with trusted providers so as not to invite liability. These services could theoretically inject malware or spyware so reputation is critical. NetNut has built up a trusted reputation over many years.

This industry is high moat also because of the ability for larger players to sue smaller players out of existence. Generally this is done through alleging some form of patent infringement; Fortunately, BrightData tried this with Alarum back when it traded under the name Safe-T Group and was rebuked and ultimately dropped the lawsuit.

Legality

This bears special discussion as it “intuitively” feels risky to invest in a company engaging in the scraping of company website data. However, scraping is the bedrock of many companies in the e-commerce, travel, infosec, and data spaces, and when confined to publicly available data is quite kosher. The landmark decision in the space has been Meta vs. Bright Data (Feb 2024(.

Meta initially used BrightData to scrape data and build profiles for e-commerce sites to better understand how to surface their ads. However, last January BrightData won a definitive ruling:

“Bright Data could not violate Meta's terms of service if it was not a user of Meta's services, a federal judge ruled.”

“Despite having access to its own computer infrastructure as well as extensive discovery opportunities, Meta has not shown any data that its users’ protected data — data not publicly available — was scraped and sold by Bright Data.”

“When subjected to established canons of construction, the Facebook and Instagram terms support the interpretation that the terms only prohibit logged-in scraping, and not logged-off scraping…” [Source]

The summary is essentially a strong upholding of the legality of data scraping which does not violate ToS and is done by non-users. This video, which includes the former head counsel of web scraping company Apify, is similarly reassuring. There is immense demand for these products and, in my view, they are not likely to be destroyed through lawfare given that ultimately doing so would run counter to the demands of nearly every large infotech company.

Catalysts

If you do not think there is going to be a continual enterprise demand for web scraping massive amounts of data, then Alarum is not for you. If you see this as competitive table stakes for almost every major company in the era of AI, then Alarum is a compelling picks-and-shovels bet.

Continued performance should be its own catalyst, especially as the company gains more analyst and fund attention. I expect a near term re-rating to a 20x EV/OCF multiple, giving upside of over 100% over 2024.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered investment advice. Investing involves risk, including the potential loss of principal. The author is not a registered investment advisor and does not provide personalized investment advice. Always conduct your own research and consider your investment objectives and risk tolerance before making any investment decisions. The author and publisher shall not be liable for any actions taken based on the information provided in this article.

Great read, thank you! Another company to check out is $CREX. It’s turn the corner to profitability and projecting revenue to grow 30% this year. Maybe one to take a look at for you. Only 40M market cap and will do ~70Mish in revenue and profitable 2024.

Great cheshbon. Really enjoyed, thank you!