Crypto ETP Company Rapidly Growing AUM and Arb Profits at 4x NTM P/E ($DEFTF)

Defi Technologies trades at 1/10th of peers, and, though a concern, cryptocurrency exposure risk can be hedged.

The market is rapidly rerating Defi Technologies ($DEFTF) so this is a less in-depth post. It is worthwhile to publish now given such appreciation and a likely uplist near-term. Keep an eye on this post for future edits and updates.

I am long $DEFTF with an average of $1.04. The stock now trades ~$1.9. This recent move was partially due to the company’s adoption of a Bitcoin Treasury strategy and partially due to a 10% buyback announcement. However the fundamental story has a ways to go.

$DEFTF trades at 1/3rd the EV/EBIT of competitors and 1/10th the P/E, has investments that are substantially undervalued due to regulatory mandates, has created “reflexivity engines” through its ETP strategy, and most notably is printing cash through an arb desk. It is trading at a mere ~4x NTM P/E even after a significant run-up. Management has been explicit about there being no need for future offerings. Insiders are buying shares on the open market and a significant buyback has been announced. Management is blunt about its desire to get the stock higher before listing on the NYSE or NASDAQ.

That’s not to say Defi has no shortcomings. Historically dilution has been brutal. The financials are confusing. The company’s ability to coherently deliver its narrative leaves a lot to be desired. There are legal concerns which are inherent to the sector even if the company itself has a “legality-first” mindset. These factors are hedge-able in a straightforward manner.

Background

This video from a recent conference provides a robust summary of the company’s background, aims, and potential. Yet it is quite confusing. Therefore this writeup focuses on clarifying the questions introduced by the long pitch. In any case, at only 372 views, investors who watch the video and read this piece will be far more informed than Mr. Market about Defi.

Question 1: What is Defi Really Doing?

Defi operates through several segments and has a convoluted corporate structure. But the company can be simplified by focusing on its key profit drivers. These are:

ETP listings and management (via Valour)

Arb trading (related to listed assets)

Investments/Venture

Question 2: How Does Each Driver Make Money?

Unfortunately the company does not break out sector-specific revenues. I will try to get clarity on this from management. The nature of the complex corporate structure obfuscates three fairly straightforward businesses.

ETP Listing

Valour Inc. provides ETP and KYC cleared listed equity products such as BTC, ETH Zero, Solana, etc. Before diving in its worth reviewing the obvious forerunner in this area, Grayscale and its eponymous Bitcoin Trust.

Founded in 2013, GBTC 0.00%↑ operated as a private trust for over a decade due to the SEC’s hamstringing of crypto-related ETPs. Private trusts face severe restrictions. The trust was only tradable OTC. Only accredited investors were allowed to participate. Pricing was inefficient and often deviated severely from $BTC’s price—and compounding this factor was the reality that share issuance/redemption were complicated. Finally, management fees were high as a result.

In January 2024, the SEC made a transformative decision allowing GBTC 0.00%↑ and others to convert to a spot ETF—which remedied the above issues. Accessibility to retail investors meant that anyone could allocate to Bitcoin. The result has been mass inflows to Bitcoin ETFs—which then go out and buy $BTC at spot prices, causing $BTC to rise. Without something like an underlying multiple to anchor prices, $BTC can trade at essentially any price without being overpriced or underpriced. This reflexivity has driven $BTC—and therefore crypto’s—trading dynamics over the past year. Consider the recent daily inflows into BTC ETPs:

As long as there is demand for a cryptocurrency from retail investors, a similar dynamic is created after the listing of an ETP product. Defi has taken advantage of this and in turn scaled AUM rapidly. But when compared to a Grayscale, Valour has two distinguishing strategies:

Targeting a “broad universe” of ETP products in terms of both geographies and assets

Valour lists across crypto-friendly areas in Europe, the Middle East, and Asia

Valour also “offers broader exposure beyond Bitcoin, including significant opportunities in the decentralized finance and Web3 sectors, which are typically inaccessible through public markets” (Source)

Valour offers single asset ETPs including more “obscure” cryptocurrencies like ICP, Hedera, HBAR, Core, and Chainlink

Generating profits through all available means from ETP holdings, not just through listing or management fees

This includes special arrangements with crypto governance bodies, staking, lending, and arb trading

It’s no secret that ETP providers generally are under pressure to lower fees in what will be a race to zero. Fee reduction, after all, is the purest form of alpha. However the nature of its atypical ETP products crypto means that Defi can move beyond fees for revenue generation and can incorporate staking, lending, and arb trading (which is discussed in its own section). Staking and lending are fairly straightfoward.

Crypto staking is the process of committing holdings to support the operations of a proof-of-stake blockchain network which gives rewards.

Defi is able to do this for PoS blockchains because they also run their own validator nodes meaning they can sell/buy crypto easily to reflect share issuance/redemptions.

Lending is utilizing cryptocurrency assets to generate interest income by enabling borrowers to take out loans using the supplied crypto as collateral.

Combined these factors mean that Defi can 8-10% yield on assets with yields generally being higher on chains which are less “mainstream” than BTC. With expenses essentially capped around $12m/year (per management), AUM growth beyond breakeven results in exponential revenue growth.

AUM growth is dependent both on the fluctuations of Defi’s holdings and on the demand for their ETP products—both of which are essentially reflections of the crypto marketplace as discussed in the “How to Hedge” section.

Arb Desk

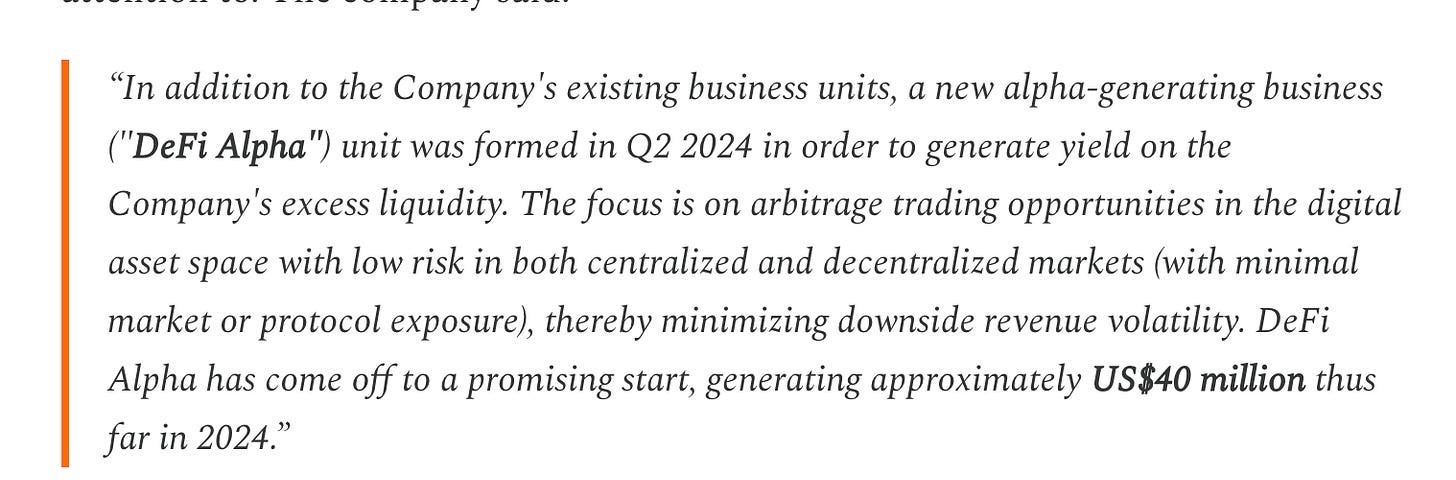

Defi’s arb desk was started in order to utilize the company’s AUM as a profit center beyond traditional management fees, staking, and lending. This has been a striking success:

The above number is stale. As of June 3rd, the number was closer to $83 million USD. What exactly is this desk doing?

Given that the company’s expertise is in listing ETP products and it is specifically talking about “low risk arbitrage trades” it likely is doing cash-and-carry arbitrage on its ETP products. If the ETP share price is higher than the asset price it tracks, Defi Alpha buys the asset and sells some ETP shares (and vice-versa) locking in the difference as profit. Because crypto markets generally are less efficient—especially when the assets aren’t Bitcoin or Ethereum—discrepancies can be very significant sources of alpha.

Defi could easily expand into other areas of arb trading with its infrastructure as well; a modified form of a block desk may be a natural fit. In such a scenario, they can pursue agreements to invest in assets (even at a discount to market value) and then pursue an ETP listing. This ultimately would be mutually beneficially for the team behind the asset (more liquidity + reflexivity) and Defi Alpha. The latter would potentially instantly generate returns, though inventory risk would have to be hedged.

Investments

Defi has made investments that are valued at $33m on the books. However this is likely a significant understatement. Their ~5% ownership of Amina Bank is probably worth ~$50 million but cannot be marked up due to regulatory restrictions. Other investments have occurred before Bitcoin’s recent bull run, so they probably are suffering a similar fate.

One notable investment is in Reflexivity Research which was founded by crypto prognosticators/influencers Anthony Pompliano and Will Clemente. This acquisition has provided Defi with low-cost outreach towards millions of people. This is utilized by the company and Anthony and Will to spread the story and potentially attract AUM. This acquisition was all-stock, so incentives are aligned and Defi essentially has an extremely impactful IR team.

How Can We Reconcile Historical and Projected Financials?

Looking historically management’s projections in the above video seem hyperbolic. But this isn’t the case on examination. The economics of this business rely on a certain levels of AUM for profitability and Defi’s AUM growth is significant. Defi’s AUM has grown from ~$200m in 2023 to $650m USD at time of writing.

This makes sense given that Bitcoin and Solana have gone up 300% and 600% respectively since January 2023. This dramatically increased the value of assets already held, but as mentioned has also resulted in inflows into crypto ETP products.

At these levels given a $12m/cost for ETP listings which should be fairly consistent, additional AUM growth represents pure upside. At an 8% yield—and before the arb desk—their 2023 AUM would therefore be insufficient to generate profit. Mathematically the numbers do make sense based on current AUM.

However projections do not account for the impressive performance of the arb desk, nor do they incorporate the true value of investments e.g. Amina Bank.

Valuation

Obviously—and as discussed below—much is dependent on the price of Bitcoin. Although Defi’s largest holding is Solana, Bitcoin ultimately drives crypto prices so it is a better proxy. Management includes Bitcoin at $100,000 for many of their projections, which is not unreasonable but is not following conservative principles. Being more conservative, let’s assume that Bitcoin fluctuates around $65k for the next few years. This seems reasonable given that, as the quintessential risk-on asset, Bitcoin should benefit from:

Rate cut(s), likely to begin by September

Increased crypto adoption with an ETH Spot ETF likely to be approved by September per Gensler

Companies continuing to be rewarded by the market for adopting a Bitcoin treasury strategy, e.g. MSTR 0.00%↑ and SMLR 0.00%↑

Recent inflationary scares making fixed-supply assets conceptually appealing

Of course in a recession Bitcoin has not proven resilient. However this risk can be hedged. Assuming a $65K price for Bitcoin, we get around $62m in yield revenue. Additionally, there’s been about $80m in profit—not revenue!—from the arb desk YTD. This is a key point which has been clarified with IR per an email:

With fixed costs of around 12m this would be around $131m USD in profit. The fully diluted share count is around 325 million (still it is unlikely that options would be exercised in the near term given management’s view of extreme undervaluation and ongoing buyback). The company is buying back 27 million shares. So using full dilution, let’s say total USD market cap is 295m*$1.9 = $560m. Netted against investments including Amina bank and considering net cash on hand after recent debt pay down, the market cap would be ~$490m. This seems reasonable to net out as it’s not as if these investments are working assets.

If I am correct, this yields an NTM P/E of under 4x. Of course this relies on management’s projections being reasonable and the numbers being accurate. But it seems highly unlikely to me that management would so blatantly lie about trading desk profits (which, again, are not revenues). So just taking trading desk profits of ~$80m and netting them against operational costs of $12m—which writes off the entire ETP business—yields a P/E of around 10x. Keep in mind these numbers are incorporating dilution from options which have not yet been exercised—and which likely won’t be for the foreseeable future.

COIN 0.00%↑ is at an NTM P/E of 69x and HOOD 0.00%↑ is at 29x. Obviously these larger and more established companies deserve some premium but the discrepancy is stark.

Risks

The most obvious risk is a crypto bear market. The math in this writeup works only past a certain AUM threshold. If AUM declines, it is likely the virtuous cycles discussed above become vicious. It is worth noting that downside volatility would still present the arb desk with ample opportunities for trading however.

It’s also important to note that while management has guided that they no longer need to dilute, there are a large number of outstanding options that are in the money. Per the Planet Microcap video shared above that there is no stated desire to raise money “ever again”. This seems like an rosy promise but the buyback program is a good indication that dilution is not a risk in the near-term.

Clearly given the convolution of the story, Defi needs to improve communication with investors. It’s odd they use “Net Operating Profit” instead of “EBIT” in PRs. It is also surprising that they failed to specify their trading desk “generation” is not profit in the PR, although that is a surprise to the upside. It seems this has not yet been realized by the market at large.

There was also a change of auditor in January 2024. This was the result of a broad-scale enforcement action against BF Borgers by the Candadian Public Accountability Board. Later the SEC fined Borges for malfeasance. Many companies (including famously $DJT) were affected as can be seen below. There were no material restatements of Defi’s financials post the completion of a new audit, but the association is a bad look, regardless of mitigating factors.

A final red flag—although a common occurrence for microcaps trying to uplist—is the use of paid promoters. The company is clearly trying to get its stock price up so to meet the NYSE or NASDAQ’s $2 threshold price. Personally this does not bother me—the stock does seem quite undervalued—but this may cause many to look askance. And fairly so. It also brings into question management’s judgement, given that they have excellent influencer marketing already through Anthony Pompiliano and others:

The annual meeting is occurring on June 25th and will be a good opportunity to ask for clarification on these risks, red flags, and the value of promotionality.

Call Options

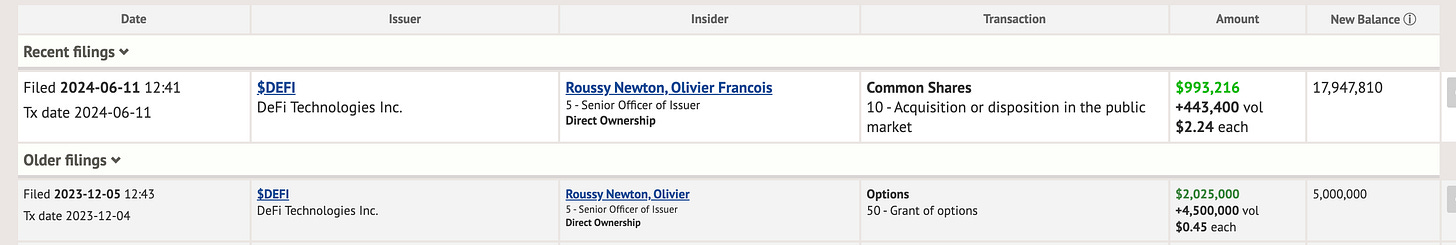

There are a variety of interesting factors that could contribute to upside. Obviously a less conservative valuation is appropriate if crypto appreciates. Additionally the buyback may drive prices near term. There’s also been significant insider purchasing on the open market recently from Defi’s founder at $1.63/share USD. This is quite notable given that it has occurred after the recent runup:

There are political catalysts too. The SEC has softened on a spot Ethereum ETF. Gensler stated just today that spot ETF approval should occur by September. Trump has recently flip-flopped and become staunchly pro-crypto, so his election might be a positive catalyst—though Biden has leaned more into crypto recently too. Both candidates have to appeal to undecided/independent voters.

How to Hedge

There’s no shortage of hair here. But there’s also been fairly explicit statements from management about revenue projections and profitability, coupled by insider buying. The AUM increase reported by the company mathematically checks out. Keep in mind as mentioned before that BTC has 3x’d and Solana has 6x’d since January 2023. At current BTC levels the stock is undervalued and has a clear path 2x or more over the coming months. However there’s no need to take on that risk.

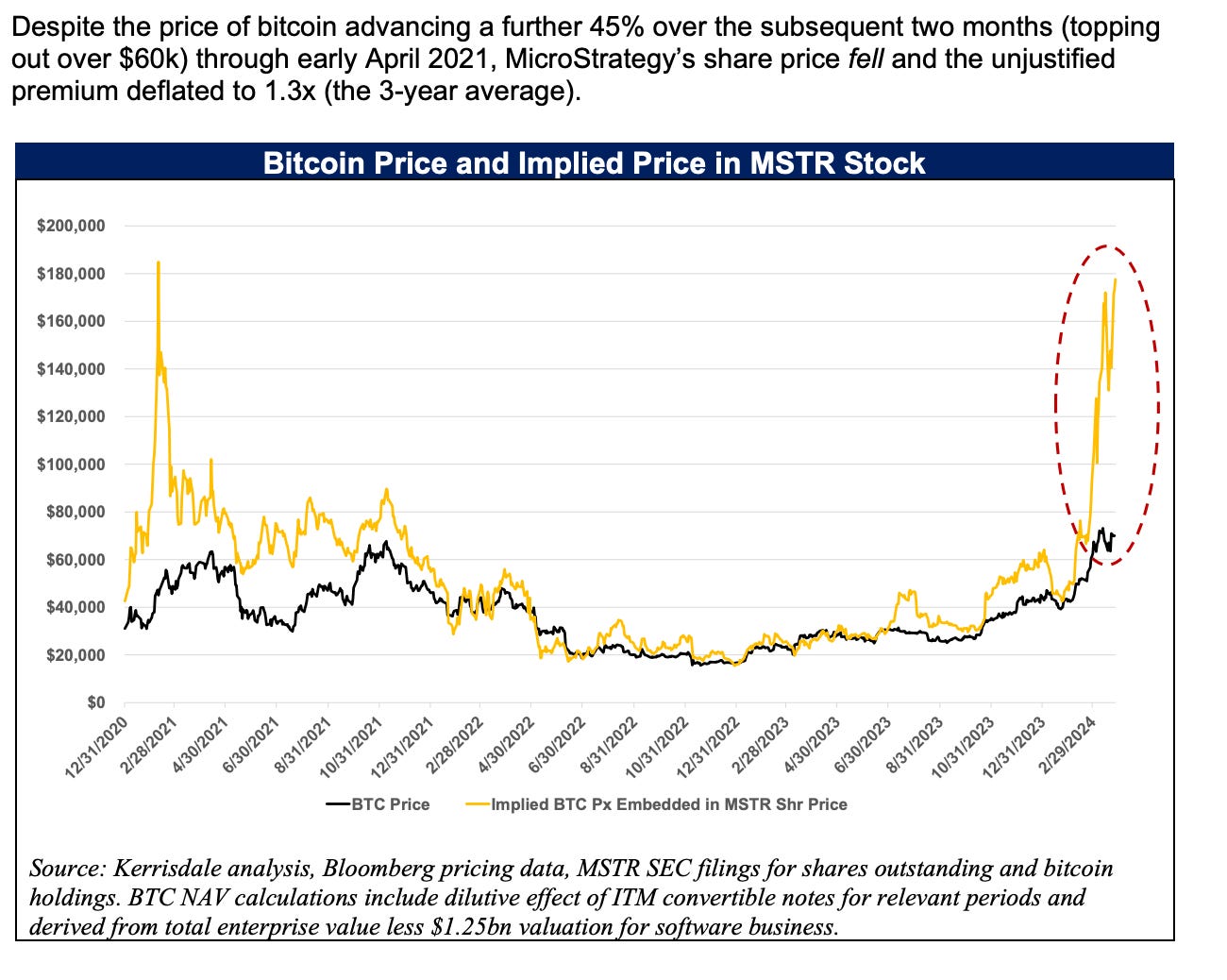

Avoiding a direct crypto short (e.g. Solana, Defi’s largest holding by AUM) seems advisable since Solana could conceivably continue appreciating rapidly especially compared to widely known and institutionally familar “blue chip” cryptocurrencies like Ethereum or Bitcoin. However MSTR 0.00%↑ is a strong short pair.

Both companies are largely reliant on crypto sentiment. However Microstrategy burns money while—at current AUM—Defi will print it. Defi’s AUM can scale without significant investment whereas Microstrategy must dilute to purchase more Bitcoin. Further, Defi’s yield is at 8-10% on ETP products, whereas Microstrategy receives barely any management fee as Kerrisdale has pointed out:

Kerrisdale also notes that MSTR 0.00%↑ continues to trade at substantial premium to NAV. This can lead to poor performance even during times of Bitcoin appreciation, furthering the appeal as a short:

Conclusion

It’s worthwhile to have some crypto exposure given the catalysts mentioned above. Defi is a good way to do so. Unlike almost every other company in the space it is fundamentally undervalued. If management’s projections are borne out a 4x NTM P/E is absurdly low. It’s also worthwhile to hedge a play like this, e.g. with $MSTR. This company is fundamentally confusing and in a somewhat “icky” industry. But confusing, “icky” companies can make investors a lot of money.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered investment advice. Investing involves risk, including the potential loss of principal. The author holds a material position of the security discussed. The author is not a registered investment advisor and does not provide personalized investment advice. Always conduct your own research and consider your investment objectives and risk tolerance before making any investment decisions. The author and publisher shall not be liable for any actions taken based on the information provided in this article.