Dramatically Undervalued SAAS Company Primed for Buyout ($AWRE)

Aware trades at .72x EV/OCF despite having transitioned to a cash-generative SAAS company growing ARR at 20% YoY.

Introduction

Aware is provider of biometric identification solutions for the border management, financial, enterprise, law enforcement, testing, and gaming industries. Biometrics are unique physical characteristics that serve as personal identifiers, allowing for physical and virtual access control. They avoid failure points inherent in traditional authentication methods like passwords, PIN codes, and access cards. Biometrics are anti-fragile—a “necessary evil” in an ever less trusting world.

CEO Bob Eckel’s turnaround efforts have transformed Aware from an enterprise software company with lumpy, fluctuating revenue to a SAAS company with predictable recurring revenue. Aware recently became OCF positive—and per management guidance will soon be EPS positive as well. The company has no long-term debt. With $1.44 per share in net cash and shares ~$1.75, the company trades at ~.72x EV/OCF, which is a drastic mispricing for a company growing both total revenues and ARR by >15% YoY. I believe AWRE 0.00%↑ will be acquired at a significant premium within the next few years. If Aware management chooses to stay independent, shareholders will still be rewarded through organic growth and ongoing buybacks.

Biometrics

We are in the era of new threat vectors—cyber attacks, deepfakes, border insecurity. As these threats increase so does the need for biometrics. In one notable recent example, a Hong Kong finance worker wired out $25m after being defrauded by a deepfaked “CFO”. Biometrics is a $50 billion industry today and is projected to grow at a 15% CAGR over the next several years.

Company Overview

Aware was founded in 1986 in Boston, Massachusetts. It focuses on face, fingerprint, voice, and iris identification solutions. The company holds 80+ patents supporting its products. The 5 main product lines are as follows:

AwareID

SaaS offering providing identity verification and continuous authentication

Leverages Knomi for face/voice matching, liveness detection, document validation

Typically SaaS with usage/transaction pricing, also available on-premises

Knomi Mobile Framework

Mobile biometric authentication framework built on optimized SDK components and server

Enables strong, multi-factor, password-free authentication from mobile devices

Sold as fixed term subscription license or perpetual license

AwareABIS

Automated biometric identification system (ABIS) for large-scale identification and deduplication

Sold as fixed term license based on system size or subscription model

AFIX

Used for small-scale law enforcement focused biometric identification

AFIX Tracker supports fingerprint, palmprint, latent print ID for 15k-2M identities

Sold as perpetual license or fixed term subscription based on system size

BioSP - Biometric Services Platform

Biometric integration platform-as-a-service (iPaaS)

Enables biometric data processing, management in web services architecture

Sold as perpetual license or fixed term based on users, transactions, enterprise

Notes on Moats

One might intuit that biometric identification is a commodity and that companies will inevitably price-compete until margins are eroded. While there are significant competitors like Thales and Idemia and an influx of new entrants, Aware’s position in the biometrics landscape is better than the market is giving credit for.

Switching Costs

Aware is quite sticky with over 90% renewal rates per its 10-k. When one has integrated a software or hardware system, particularly one which involves in-situ components or software installed on employee devices (in the case of Knomi) it is quire a hassle to switch to another provider.

Winners(s)-Take-Most Dynamics

Biometrics is the very definition of an unforgiving industry. A 99.999% success rate is worth multiples more than a 99% success rate, because one finsec/cybersec failure can cost millions of dollars (think of MGM’s recent hack). In the case of border security, failures can be even more costly. Given this, the market structure tends toward oligopoly with the best performing products dominating the landscape. The NIST often releases reports on differing performance of biometric systems and Aware is consistently ranked as a top performer.

Beyond product performance, Aware importantly is a full-service identification provider; it has no process outsourcing, e.g. sending data to another company’s server for evaluation. Additionally, Aware’s profitability means that it can invest around $7m into annual R&D.

Demographic Considerations

Racial and age considerations are key when it comes to biometrics. Customers are loathe to create situations where they may be sued or disparaged for erroneously questioning employee credentials. Aware has been in biometrics since 1993 and has a vast database—beyond most competitors—of biometric information. Its models outperform on racial disparity tests.

Geographic and Reputational Advantages

Unlike in other technological spaces (e.g. EVs) it is unlikely that new entrants from countries like China will undermine the economics of current players. Aware is an American company that has spent over 30 years forging relationships with over 100 commercial lenders and 80 government agencies. Its clientele are not going to trust non-Western entities without a very good reason to do so.

Financial Overview

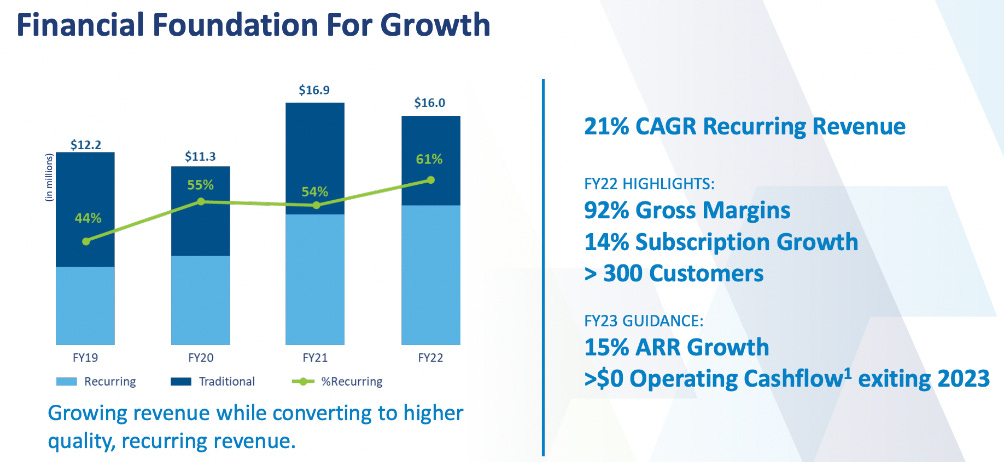

With the 2019 appointment of CEO Bob Eckel, Aware began transitioning to a subscription based, ARR-focused company. Previously, Aware was mired by lumpy revenues as a result of selling its products via one-off enterprise contracts that had to be continuously renewed. ARR is now growing at a 20% CAGR; it comprises a majority of revenue. ARR is greater than total revenues when Bob joined.

It should also be noted that Aware trades ~$1.75 and has $1.44/share in cash on the balance sheet. It is unlikely they will need to dilute in the foreseeable future. Management has not been dilutive and is using excess cash to buyback shares. Over the past year, they bought back 299,780 at $1.67 per share. The current float is ~14.9m.

Last quarter’s net income was negatively impacted by a one-time, $2.7 million write-off related to a March 2022 investment in Omlis Limited. Still, Aware generated $3m in OCF and has been OCF positive for two quarters. It is guiding towards sustained OCF profitability from here.

With little CAPEX spend, it seems reasonable to use EV/OCF as a valuation metric. Annualizing, Aware is trading at an EV/OCF of ~.72x. For a company that has 61% recurring revenues, and is growing these revenues at a 20% CAGR this is simply too cheap.

The fact SG&A has grown in line with revenues jumps out. To conclude that this means Aware can only scale insofar as it scales its sales team—and thus does not deserve a “SAAS multiple”—is naive. ARR alone is growing at 10% more than SG&A spend. With strong renewal rates, Aware could stop actively growing its sales force/efforts and begin generating far more cash. However management is investing aggressively in sales today to enhance future recurring revenue. Margins should increase as SG&A tops out over the next several years.

Acquisition/PE Target

I would be surprised if Aware were not taken out by PE within the next few years:

The transition to a SAAS has not just resulted in “fairer” pricing for customers, allowing them to pay for only the services rendered, but has ameliorated the revenue lumpiness that the company long suffered from. A sponsor can better model future financial performance now.

The company has no debt and a strong cash position, meaning that it can sustain significant leverage during an acquisition.

Interest payments would be manageable. Further, a sponsor with a biometric PortCo likely could achieve significant SG&A synergies by combining Aware with the already held company.

Aware’s IP is highly valuable and puts owners in contact with numerous branches of government and several financial firms.

I could also see a strategic like GEO 0.00%↑ taking a look since Aware would complement its ATD (alternatives to detention) segment.

Most importantly there is precedent. Past writeups have overlooked Bob Eckel’s former performance at Morphotrust. Morpho was sold for ~$2.7 billion, per Bloomberg, to Advent International during Bob’s tenure as CEO. Per LinkedIn:

"As CEO of MorphoTrust, Bob oversaw a $500m business with more than 1,800 employees and drove the integration of 78 companies. He established business and organization processes and a secure classified Proxy (DSS) and National Security Agreement (CFIUS) infrastructure while delivering a wide array of security and identity services, including secure ID and credentialing, US Passport personalization, identity enrollment, background check services, and biometrics… He drove the business plan for MorphoTrust as part of the Morpho Business sale to Idemia/OT.”

There is incentive to pursue a sale. Insiders own 48% of outstanding stock with Bob owning 5%. What’s intriguing is that management compensation is predicated on far OTM options; compensation is rather low otherwise. I am not saying this is likely—I think it will be taken out beforehand—but were Bob able double revenues before 2029 by continuing to grow ARR at a 20% CAGR, the acquisition premium could see him receiving a high 8 figure payout (@ $10/share).

Finally, it is interesting to note that on recent conference calls, management has emphasized they will continue to evaluate “all strategic options” to create value for their shareholders.

Valuation

Details of the Morpho acquisition were not made public. Based on the rumored Bloomberg offer size and 2015 Morpho revenue numbers released via an Office of Public Affairs report it seems it the acquisition was made around 8x sales.

If Aware was acquired at a similar revenue multiple after a few more quarters of growth it would be around $7/share. This, however doesn’t account for the company’s balance sheet and the geopolitical and technological tailwinds making biometrics more important.

On the other hand, if Aware organically grows ARR at a 20% CAGR and continues buying back shares, I calculate EPS reaching ~$.50 by 2029. At a 20x SAAS multiple, midline for more mature SAAS companies, you get $10/share before any acquisition premium.

Risk Factors

I would like to see more revenue diversification. Per the 10-K, “One customer represented 17% of total revenue in 2023.” That being said, “no customer represented 10% or more of total revenue in 2022.”

While I have talked about Aware’s competitive advantages, it is worthwhile to note that many young, hungry biometrics entrants are entering the arena. YC has funded several companies specifically around deepfake detection. Silicon Valley is well aware of the opportunities biometrics presents; there is a reason why Altman’s Worldcoin focuses on iris-scanning. If these companies can establish good working relationships with financial and government entities, Aware would suffer.

Perhaps the biggest risk factor is the governmental regime. As administrations change, contracts must be renewed. One hopes that management has made inroads with decision makers on both sides of the aisle, particularly in the case that a border bill passes with with significant ATD (alternatives to detention) funding.

Opportunity

As you can probably tell I am shocked by Aware’s share price of $1.75 (at time of writing). Aware has been written up numerous times on sites like VIC; it’s not an unfamiliar story. However, perhaps this is a case of familiarity breeding content. Here are some reasons for the apparent mis-pricing:

Past write-ups demonstrate that investors have continually believed Aware is a single transformative step away from achieving its rightful valuation. As this has not yet borne out investors may have thrown in the towel.

The company has spoken consistently about its ARR focus, but the success of this initiative has been demonstrated only recently.

Biometrics is viewed as an intensely price-competitive industry; a “digital commodity.” As discussed earlier, this conclusion is not so clear.

AWRE is a nano-cap illiquid stock with no analyst coverage and exceptionally non-promotional management.

Ironically, the company’s strong cash position is part of why it is so undiscovered: it does not need to engage much with investment banks.

I will go out on a limb and say that this time is different—the numbers finally support the narrative.

Conclusion

Shareholders of Aware own a business that experiences increased demand after geopolitical turmoil, cyberattacks, border disputes, etc. Mega-trends like AI and illegal immigration serve as tailwinds. The balance sheet provides significant downside protection. If you lose, you won’t lose much. You will, however, enjoy growing OCF and continued buybacks. One day, you will likely wake up to an acquisition at a significant premium.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered investment advice. Investing involves risk, including the potential loss of principal. The author holds a material position of the security discussed. The author is not a registered investment advisor and does not provide personalized investment advice. Always conduct your own research and consider your investment objectives and risk tolerance before making any investment decisions. The author and publisher shall not be liable for any actions taken based on the information provided in this article.

Hello MultiBagger Monitor, Any revised opinion on AWARE now trading almost at cash level 😀?

What a day! Is this your best performing day ever? Seems like all of the ideas I learned about first from you are working at the same time.