Golden Dome, Quantum, Next-Gen GPS, Oh My... ($FEIM)

$FEIM has exceptional thematics, aligned management, and a storied pedigree. When the market pays attention, it could this microcap's "time" to shine.

Introduction

Frequency Electronics is at the intersection of several exciting thematics.

As the undisputed US leader in precision time and frequency solutions for satellite applications, the company benefits from the surge in A&D spend via the Golden Dome initiative. This undertaking has a staggering estimated spend of a $500 billion+, and has been compared to the Manhattan project. And Frequency is currently benefitting from U.S. strategic satellite proliferation—which should only increase.

Both Golden Dome and proliferation are top priorities for national security. Given these tailwinds, it’s surprising that the PT&F core business—which has monopolistic characteristics—trades at the lowest LTM EV/EBITDA multiple since 2016.

$FEIM’s other thematic is quantum. The company’s emerging quantum sensing business allows it to leverage its R&D expertise and relationships with top national laboratories into real quantum applications—unlike other quantum names.

Actually, Frequency is currently generating revenue from several of these applications today. For example, a recently announced collaboration with Leidos (a $20B defense heavyweight) and the MIT Lincoln Lab uses quantum technology to inure against electronic warfare:

Quantum sensing is by far the most mature of quantum applications. And Frequency has deep industry connections (as discussed later). Yet Frequency’s emerging quantum sensing opportunity is overlooked by the market. This is surprising given the absurd runs in other quantum names, some of which lack serious technology:

This piece first examines the core timing business, and then the blue ocean quantum sensing opportunity. To better understand both, it’s also recommended to watch Frequency’s presentation at the Needham Growth Conference.

Precision Time and Frequency - Overview

The precise ability to measure time and frequency enables numerous multi-billion dollar industries. The bolded areas are where Frequency focuses:

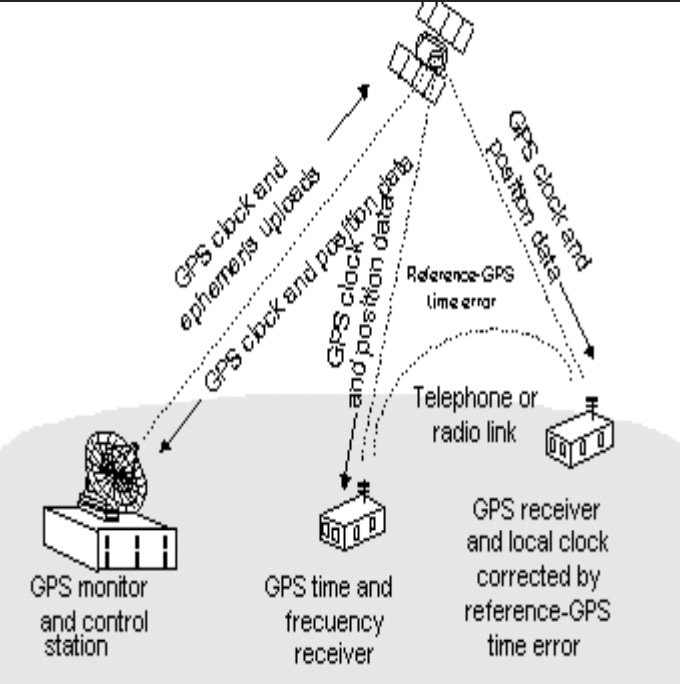

GPS - Allows GPS satellites to calculate exact positions by measuring timestamps between signal/receiver

Wireless Communication - Coordinates signal transmission and avoids interference

Sensor Synchronization - Allows data collection coordination, enabling monitoring/autonomous systems

Air Traffic Control - Tracks movements of physical objects to their precise locations

HFT/General Trading - Allows programmatic trading with precision and accurate timestamping

This NASA document is worth a read and examines a highly illustrative example of GPS applications:

Atomic clocks—most relevant for Frequency—are a subset of the overall PT&F industry. But, they are the most accurate, specialized, and costly subset of products. The next section explores Frequency’s specific offerings and specialization. The atomic clock market is currently around $600m/year, and is projected to reach $1b/year by 2035. This squares with Frequency’s own estimations:

“The total high precision time and frequency market is expected to grow substantially. FEI’s addressable market is projected to increase from today's under $500 million to over $1 billion per year, particularly for space related products. FEI's goal is to capture a larger share of this growing market.”

Frequency Electronics - PT&F

In the U.S., $FEIM is a leader in PT&F, and the leader in PT&F for space applications.

Per the company, its “products are used in commercial, government and military systems, including satellite payloads, missiles, UAVs, piloted aircraft, GPS, secure radios, SCADA, energy exploration and wireline and wireless communication networks. FEI has received over 60 awards of excellence for achievements in providing high performance electronic assemblies in over 120 space programs.”

For example, the company’s tech was selected for both Voyager missions:

And the company has continually been selected for programs in recent years:

These are disclosed programs, but are only a fraction of Frequency’s revenues from this division. Many programs are ongoing (and therefore undeserving of announcement) or are classified (and therefore cannot be announced).

To better understand the vast extent to which Frequency dominates this space, I spoke with an expert, who had 15+ years of experience in the PT&F space, including a C-suite level role at a leading non-space focused PT&F company. Here are some selected quotes:

“When it comes to space clock technology—atomic clocks in GPS constellations or master reference clocks in satellites like reconnaissance, GPS, GEO, and MEO—FEI is a bellwether… They’re a thought leader with a strong legacy.”

“FEI stands out because they offer rubidium and quartz-based master oscillators, differentiating them from others.”

“There are no vertically integrated domestic competitors.”

The fact that Frequency controls the entire production process, from start to finish, through wholly-owned production facilities, makes them unique. Their only costs are essentially raw materials.

The above factors, taken together, provide Frequency a strong moat and competitive advantage when bidding for programs. They are best in class, with unique offerings, vertical integration, and with no comparable domestic competitors. Given the projects the company works on are so critical for national security, it doesn’t make sense to go with an upstart.

Therefore, it is easy to underwrite the idea that, if the domestic market for PT&F expands, a substantial amount of the benefit will accrue to Frequency. We are currently undergoing a market expansion through a general trend of LEO satellite proliferation. The Golden Dome initiative will radically accelerate this process.

LEO Proliferation

The below is a breakdown of Frequency’s sources of revenues:

The company has significant beta to the number of satellite payloads and general government spending in its product areas. This should be a tailwind over coming years and is already in effect.

One key point made by Frequency CEO Tom McClelland at the conference linked above is that proliferating satellites is of critical importance for national security:

“A geostationary weather satellite costs $1b to put up and takes 10 years to develop and launch. Those satellites are vulnerable. The Chinese and Russians have demonstrated it takes a lot less than $1b to shoot down one of those satellites. There’s a big effort to make smaller, cheaper satellites than can be launched within around 12 months. Similarly, with existing, costly satellites, they have 10-15 year old technology… launching satellites more quickly therefore allows for more innovation.”

The SDA (Space Development Agency) highlights addressing the above as a key tenet of its strategy. In fact, it is the third (!!) question it answers on its FAQ page, only after discussing what the agency is, and explaining its motto:

As a result, the LEO satellite market is expected to grow at a rapid rate. Credible sources predict a nearly six-fold increase in the number of LEO orbiting satellites—increasing to 42,000—over the next 7 years. This is staggering, and would represent a $8-10B/year U.S. domestic market.

Golden Dome

Related to the above is the Golden Dome initiative. President Trump’s Golden Dome initiative has been both celebrated and maligned—but not well understood. The below video does a thorough and unbiased job of examining the initiative:

The program is funded with $25B for year one, and is projected by the White House to cost a total of $185B. However, the CBO estimates the actual program cost will range from $500B to $1T. If the program proceeds in full, these are unfathomable numbers. If the program proceeds in a significantly reduced capacity, these numbers are merely huge. To get a true estimate of what Golden Dome means for Frequency, it’s worth separating the reasonable and likely elements of the program from the fanciful.

The most likely actionable and politically acceptable initiatives include:

Space & ground sensor upgrades (hypersonic/ballistic tracking layer, MTI sats, new radars)

These are already appropriated for and matches pre-Golden Dome US plans

Currently ~$10B allocated

Incremental interceptor refresh: GPI for hypersonics, NGI for GMD, non-kinetic R&D

These programs are already operational

Currently ~$5B estimated

Administrative consolidation; launch/test infrastructure

Unlikely to face political challenges, “low-lift” initiatives

This will cost an estimated $500m

The more fanciful initiatives include:

Nation-wide terminal ‘underlayer’ for cities

Proliferated space-based boost-phase interceptors (“Brilliant Pebbles 2.0”)

Nuclear attack shield

It's reasonable to assume that some of the fanciful initiatives are indeed partially funded eventually, at least to the demo phase. But for conservatism, the initial $15-20B that is earmarked for actionable and acceptable initiatives seems likely to pass in whatever version of the Big Beautiful Bill passes. This establishes a precedent for further funding. Once such military programs receive initial funding it is difficult to abandon them.

Further, the Trump administration can potentially ramp up Golden Dome spending in the next three years even before Democrats potentially have control over the White House, solidifying the program. Generally, the military-industrial complex takes care of its own.

Additionally, the Musk-Trump breakup should only serve to help non-SpaceX bidders for the project. SpaceX will certainly still be involved, given how deeply they are integrated into satellite design and government space programs, but discretionary dollars are now more likely to flow to other bidders. Major U.S. defense contractors like Raytheon and Lockheed Martin are poised to benefit. Consider Lockheed’s homepage:

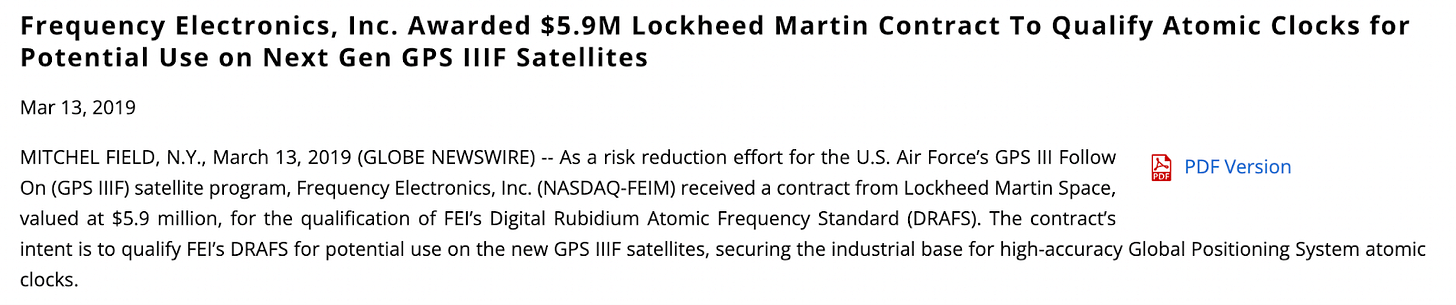

Frequency has an established relationship supplying many of these primes, with a particularly deep relationship with Lockheed:

It should be noted that the above GPS IIIF satellites are slated for launch in ‘27 and they are slated to launch these satellites through SV20, which will occur not before December 2030.

PT&F Valuation

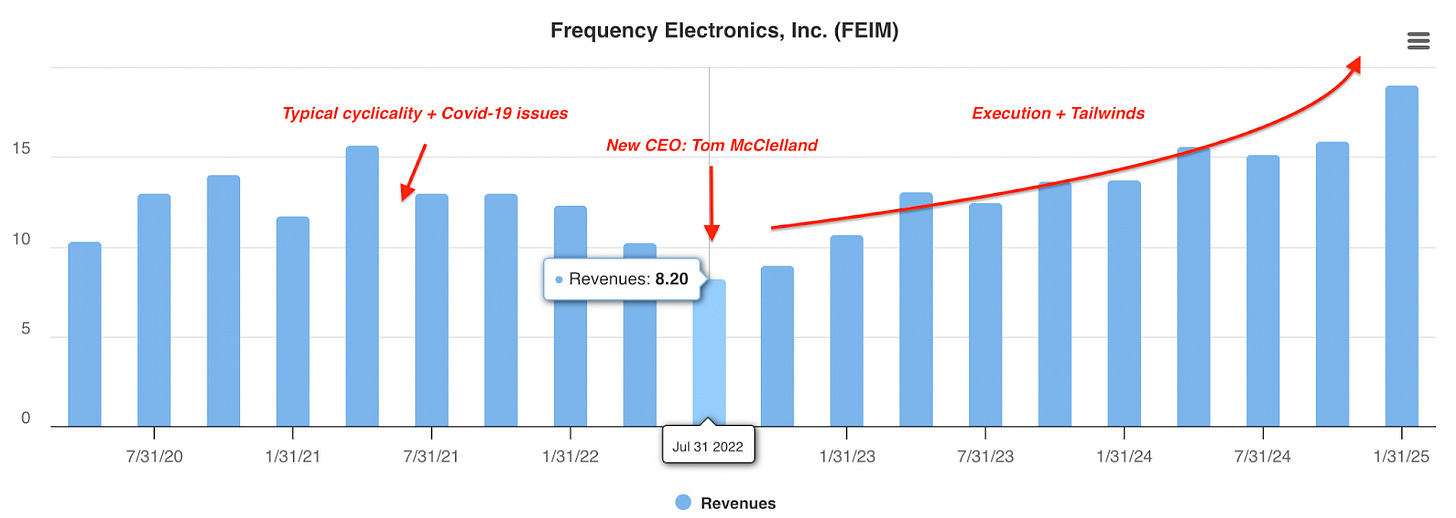

The largest issue for Frequency’s PT&F division historically has been cyclicality. Revenues have ramped and declined with the appetite for space funding. This has seen the company oscillate from NI positivity to negativity.

For the reasons stated above however, there is now good reason to believe we are at undergoing a meaningful inflection—one that would demonstrate a sizeable uptick in future revenues on a sustained basis.

Domestic supply chains and scientific know-how will be front and center of selection criteria for both increased orders (as satellites proliferate) and subcontracting (as Golden Dome ramps). It’s also worth noting backlog numbers (which rose from $53m in year end ‘23 to $73m in year end ‘24) demonstrate continuation. We are already seeing this take place:

Valuation metrics are insufficiently pricing in this inflection. Over the last 12 months, Frequency’s P/E ratio has been 7.64x. This is low, but misleading, due to the company’s utilization of its deferred tax assets.

It’s generally better to consider LTM EV/EBITDA for Frequency, given historical swings to net losses (and the potential to lever up and acquire this business). On an LTM EV/EBITDA basis Frequency trades at 13.85x.

At year ends, from 2016 to now, the company's multiple is essentially the cheapest it has ever been. This feels simply incorrect given the aforementioned tailwinds:

As revenues shed their cyclicality as satellite spend goes from discretionary to perennial, there’s no reason the multiple shouldn’t expand to at least 17-20x, where it has been in the past.

Alternately, this segment can be valued on a TAM basis. Atomic clocks as mentioned are a $600m TAM, growing 10%+ annually (conservatively) through the next decade. This market is only a subset of $FEIM’s competencies within the FEI-NY segment, which is currently 70% of group revenues.

Assuming Frequency captures only 1/3 of the market, with operating margins in the 10% region (vs. 9.1% in 2024), Frequency’s operating income could be approaching $30m by the end of the decade for this specific product alone. With a current market cap of $180m and EV of c.$160m, this translates to just over 5x EBIT / EBITDA. This is when only accounting for a portion of the business—and assigning 0 value (!) to the promising potential of the quantum sensing opportunity described below.

Quantum Sensing

Quantum sensing refers to utilizing quantum properties (e.g. entanglement) to make extremely precise measurements. There are numerous applications, many of which are covered in this excellent video. Measurement may not sound exciting—but it is. These links contain numerous examples of how quantum sensing can represent tangible advancements in various industries:

Quantum sensing is poised to accelerate rapidly and benefit from the attention brought to quantum applications from quantum computing (though, ironically, it is a much more advanced industry).

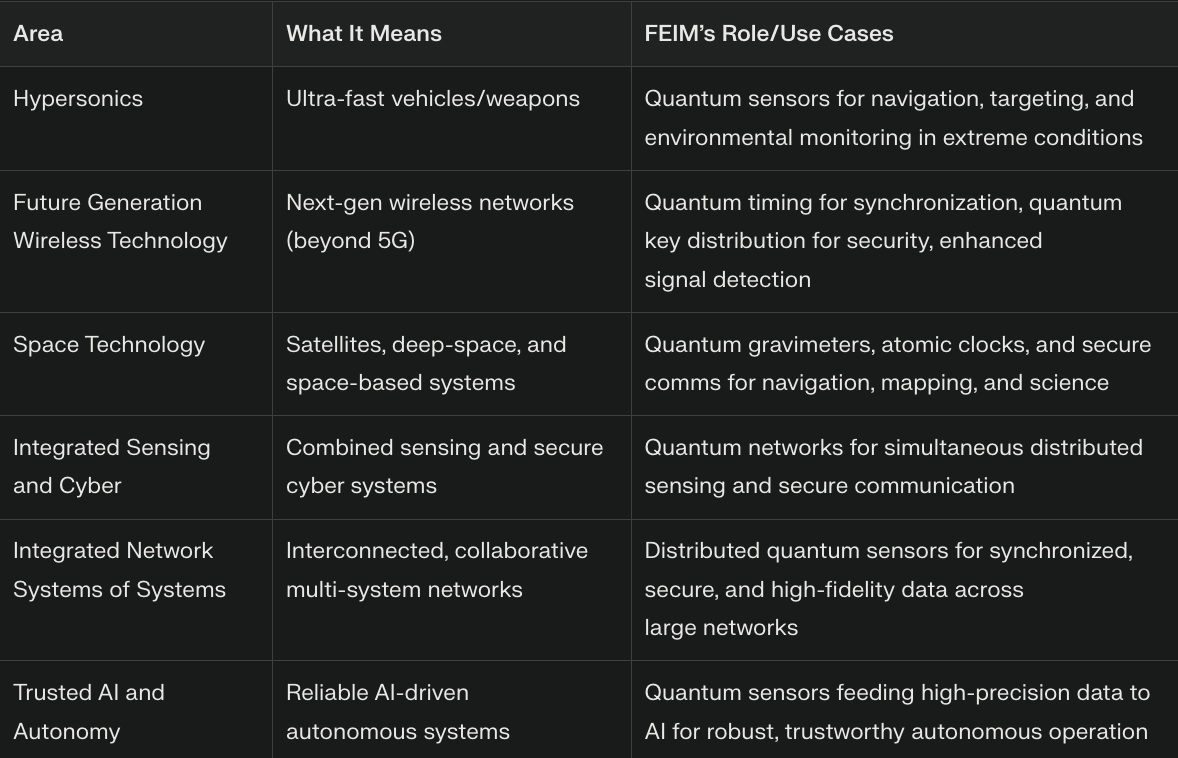

Areas of particular relevance for Frequency are highlighted below (emphasis mine):

Frequency Electronics - Quantum Sensing

In the above areas, Frequency is working to establish itself as a major U.S. industry leader through various stratagems. First, it began hosting an annual quantum sensing summit in ‘24. This involved a veritable who’s-who of presenters. I’ve highlighted biographies which stood out to me (although every speaker is impressive):

It seems rather astonishing, and promising, that the head of quantum sensing for DoD, Sandia National Lab, the Air Force Research Lab, the NIH, NASA, Northrop Grumman, and Lincoln Lab (not to mention the other resumes represented) all have established/developing relationships with a $170m market cap company. This summit should serve to deepen and continue these relationships as quantum sensing grows as an industry. This recurring summit is a smart move by Frequency.

More importantly, Frequency is currently actively generating revenues from next-gen quantum sensing work. One pressing concern for the Trump administration—deepened by the learnings of the Russia-Ukraine war—has been developing technology to avoid GPS jamming and enhance GPS resilience. Just this week the official FCC account retweeted an article to this effect:

To this end Frequency has partnered both with Lockheed on its next-gen GPS satellites (as discussed above) and more recently with Leidos—a $20B defense leader—and the renowned MIT-Lincoln Lab to develop quantum technology to thwart GPS jamming. This is a multi-year contract and should establish a beachhead and credibility for further quantum sensing projects.

The company is also working to apply next-gen quantum sensing to several other areas critical for national security, before diversifying into high-growth applications that also could see significant revenues from industry. Hypersonics are currently a key market (which again ties back to Golden Dome):

It’s worth examining the below table, highlighting exactly what is meant by the somewhat mystifying terminology used in the above slide:

Finally, it’s worth noting that the government likely will pour money into this space, given the clear benefits that U.S. dominance would provide for national security and global competitiveness. The fact that Frequency is “getting to know” the heads of R&D labs through its quantum summit should help it receive funding:

Quantum Valuation

Essentially, the above indicates to me that Frequency is doing very well to establish itself as a leader in this critical, emerging field. That is not priced in, likely because it is hard to properly how this translates to hard numbers today. If, by 2030, quantum sensing is a $1B industry, I’d argue that Frequency is as positioned as any company to derive significant revenues, and I’d predict them to initially come from their work with Leidos.

I quote: “Ultimately, Leidos intends to fly a MagNav system with the new magnetometer [note: this is what Frequency is building]. If successful, the technology has the potential to significantly advance navigation technology for military use.”

Per CEO Tom McClelland’s comments at Needham, it’s clear that the sensing opportunity is being positioned and pursued as the future of the company. It’s hard to imagine that Frequency’s revenues cannot grow at a 10-15% CAGR with the market as a whole. However, no details on contract size were provided with regard to Leidos.

Perhaps it’s sufficient to merely note that other companies associated with quantum—but with far less mature technology and established pedigree—have seen absurd runs, while Frequency (likely because no one understands the quantum story or is aware there is one) has not.

Obviously, it is illogical to expect Frequency to go on an absurd, hype-driven run merely because others have. But, it is equally illogical to think it should have no quantum beta, when that is being messaged as the future of the company:

Catalysts

There are several catalysts that could see repricing in the near term. Obviously, I expect continued earnings execution, with earnings expected on 7/28/25. This execution has historically gone unnoticed, with zero analyst coverage. However, recent R2K and R3K inclusion should correspond with increased exposure, volume, and coverage. Because the company is unfollowed, it doesn’t trade based on newsflow to the areas it has exposure (e.g. A&D spending, Golden Dome, quantum).

A recent example: it was shocking the Frequency was down on Friday, June 13th, given the breakout of the Israel-Iran war. If anything is evident from the conflict so far, it is the importance of ballistics tracking, satellelite communication, air defense, precision measurement, and electronic warfare—all of which implicate $FEIM. In an efficient market, it should have traded up, e.g. with other defense contractors.

One catalyst therefore is market awareness, such that the above tailwinds are priced in. Perhaps this will happen partially through passage of some version of the Big Beautiful Bill, which should come in the near term, and should include concretized Golden Dome spend. Similarly, there are likely more quantum partnership on the horizon, and details around the current agreement with Leidos may be forthcoming.

Additionally, the company has paid a substantial cash dividend of $1 last year. If this were spent on buybacks—a better application, in my view—this could aid price discovery.

From my conversations, it is also apparent that Frequency is an acquisition target for other companies trying to break into quantum sensing or Space PT&F. The expert I spoke with—who currently works at a large French defense prime—shared the following:

“It's a great opportunity for them to get acquired by a larger player, including Microchip. Microchip doesn't have a good space technology. This could be a beautiful marriage. It's a U.S. company. I think companies like BAE or Safran and all those fellows will salivate to get their hands on the business. The problem is U.S. government will not let them buy FEI because this is a very critical technology for the country. It has to be a U.S. owned company. It could be L3Harris, could be Rockwell Collins, or it could be Northrop, Lockheed, Honeywell…”

“The navigation and space industry is salivating to improve the accuracy and stability of the onboard space clocks so that on the ground they get better fidelity so they can undertake missions that they're not able to undertake today. This whole Golden Dome will greatly benefit with better accuracy and sensor and timestamping.”

The company, for what it’s worth, seems open to the possibility:

Management + Alignment

I have gotten the sense that for years, Frequency was run by its founder as, essentially, a “family business”. That changed with the new CEO Tom McClelland, who began serving in this role in July ’22. It’s worth noting the stock has gone on a tear since this point, whereas it had previously suffered execution problems around the end of Covid. Tom has a PhD in Physics from Columbia. He has worked at Frequency since March ’99, so he is clearly dedicated to the company’s success.

Frequency management is high-quality and aligned. Management and executives own ~26% of the company. The largest outside shareholder is Jonathan Brolin via his fund Edenbrook Capital; Brolin has also served on the board since 2017. Edenbrook is the largest single shareholding entity, owning 19% of the company. This blurb will be quite appealing to investors:

In addition to Jonathan, the board is exceptionally strong with deep defense industry, capital markets, and engineering expertise.

Richard Schwartz served as CEO of ATK and notably received the Queen Elizabeth Prize for his work with GPS technology. This is one of the most prestigious engineering prizes; the most recent winner was Yann LeCeun.

Lance W. Lord is a retired four-star general who served as the Commander of Air Force Space Command: “While with AFSPC at Peterson Air Force Base in Colorado, General Lord was responsible for the development, acquisition and operation of Air Force space and missile weapon systems. Overseeing a global network of satellite command and control, communications, missile warning and launch facilities to ensure the combat readiness of the U.S. intercontinental ballistic missile force, he led more than 39,700 personnel who provided combat capabilities to North American Aerospace Defense Command and U.S. Strategic Command.

Russell Sarachek is the final board member with an A&D and capital management background. He owns $9m worth of shares and has recently been adding to his position:

Risks

It’s interesting to note that there are few intangible assets on the balance sheet. One would think that the company would place a greater emphasis on thwarting competition via IP protection. However, the company disagrees:

I don’t really buy the above. It is more likely, in my view, that it may be the case that it’s not worth the company pursuing patents as they might disclose processes or trade secrets in doing so. If that is not the case, and the company truly is not relying on IP, that decreases the “tech” moat.

While there are no vertically integrated domestic competitors with a space focus, there are other strong, well-capitalized companies in the PT&F space. Microchip stands out due to the depth of its government relationships. It seems unlikely they would be able to beat Frequency head-to-head today, as this vertical is currently not large enough to justify the source of work that would entail. However if Frequency grows, so does the risk of their entry.

It is nearly impossible to get in touch with the company; I was unable to talk with management even after several emails. Many investors read this as non-promotionality, and see it as a virtue. I see it as a fundamental misunderstanding of modern capital markets. It is crucial to talk to the market—not to promote, but to communicate. Lack of communication often scares off potential investors, or simply makes a company feel “too hard to figure out.” The same, by the way, goes for the lack of analyst coverage. This company is extremely difficult to figure out from a technical perspective, and the market won’t give it full credit if it does not understand the it.

The company is completely (~98% of revenues) dependent on government contracting. If it falls out of favor with the government, it may suffer major setbacks. The company appears non-political, so an Elon situation is unlikely. However, a crucial failure of tech for a high-level project would be extremely deleterious. And if government space/defense spending enters a down-cycle, the company will be exposed…

The TAM of atomic clocks is limited by national security. There is little precedent for Frequency selling to other nations. The same works in reverse—even our closest allies, like the Brits, have their own domestic equivalents. I believe this market is large enough to support continued growth for years. However, compared to quantum sensing, there is a limited TAM.

Conclusion

Frequency is a complex business with a simple thesis: everything is going right, and the market is not pricing that in.

Generally:

The company is unnoticed and overlooked. If that changes, investors may benefit.

This is a company of extremely high quality.

Management and insiders are aligned.

On PT&F:

A company with monopolistic traits and which stands to be arguably the purest public beneficiary of a potential $500B-$1T government spending program, should not be trading at its lowest EV/EBITDA multiple in 10 years. This seems plainly wrong.

The company is a way to gain Golden Dome beta without idiosyncratic risk relating to which prime wins the largest contracts; it has deep relationships across leading beneficiaries, e.g. Lockheed and Raytheon.

Regardless of Golden Dome, satellite proliferation will continue, and initiatives like GPSIIIF are exciting sources of revenue. The YoY year revenue improvements we’ve seen should continue—with less cyclicality in the past.

On quantum sensing:

Quantum has unwarranted hype in general. But quantum sensing is by far the most mature quantum industry. Frequency is positioning itself as a leader and establishing connections across government branches and A&D companies.

The mere fact that a $20B prime, Leidos, is working with them on a serious project is indicative of the potential.

This exciting, high CAGR growth pathway is also given no credit in the valuation.

The company is a way to gain exposure to quantum beta without investing in non-profitable, non-serious companies.

It may well be $FEIM’s “time” to shine.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered investment advice. Investing involves risk, including the potential loss of principal. The author holds a material position of the security discussed. The author may buy or sell at any time and without prior notice. The author is not a registered investment advisor and does not provide personalized investment advice. Always conduct your own research and consider your investment objectives and risk tolerance before making any investment decisions. The author and publisher shall not be liable for any actions taken based on the information provided in this article.

Great work. These are some precision timing comps. Rakon is interesting microcap and has had takeover interest much higher. Opened Indian facility in recent years. Space and Datacenter growth going forward as well as core Defense and Telecoms.

Rakon RAK NZ

Txc Corp 3042 TT

Sitime Corp SITM US

Microchip Technology Inc MCHP US

Siward Crystal Technology Co 2484 TT

Daishinku Corp 6962 T

Nihon Dempa Kogyo Co 6779 T

Seiko Epson Corp 6724 JP

invest then investigate :)