Hallador's "Beautiful, Clean Coal": Near Term Catalyst w/ 200% Upside ($HNRG)

An upcoming deal w/ a strong likelihood of closing could see Hallador transform from a dying coal mine into a stable IPP and rerate accordingly.

Hallador Energy is a legacy coal mining operation transitioning into an Integrated Power Producer (IPP). If successful, HNRG 0.00%↑ should re-rate to trade more like a utility than a sunsetting coal mine. This could see the stock price go from $13.5 to $20-25 in the near-term, with a longer-term price of ~$50 being reasonable. This would represent a 3.7x from last close.

Unlike other coal names, Hallador owns a power-generating station + grid interconnection rights. These allow it to potentially win long-term power purchase agreements (PPAs), locking in customers for 10+ years at fixed prices. Hallador has signed and exclusivity agreement with an unnamed large data center partner. If finalized, the deal will likely be announced in May or early June. The final regulatory hurdle, Expedited Project Review, was passed last week — which the market has overlooked.

Hallador is fairly valued as a coal name, but is not meaningfully pricing in any upside from this deal. That seems absurd, given that a deal could close any day now.

Valuing Hallador is superficially difficult, but is actually straightforward given robust management disclosures and explicit contract terms. It is essentially an Expected Value exercise with two outcomes: IPP or Status Quo.

Useful Definitions

Hallador operates two segments, Hallador Power and Sunrise Coal. Hallador Power provides electricity through the coal-fired Merom plant, and Sunrise Coal represents the company’s legacy coal mining operations.

Merom is a coal-fired power generating station owned and operated by Hallador. Merom’s net capacity is 1,080 MW via two steam turbine generators.

Hoosier is the previous owner of the Merom Power Plant. Hallador acquired Merom and grid interconnection rights from Hoosier in 2022. Hoosier is still a key customer w/ a current power purchase agreement (PPA) with Hallador.

Grid Interconnection Rights allow a power-generation facility to connect to the grid and transmit electricity. Merom’s electrons can be dispatched and sold into the MISO network and fulfill PPAs. Notably, there is a dearth of accredited energy providers in MISO.

MISO is the regional transmission organization managing high-voltage electricity flow across multiple U.S. states and parts of Canada. Hallador sells wholesale energy and capacity within this network.

Bullish Scenario - IPP Transfromation

If Hallador were to sign a deal, it would essentially see Merom running near capacity for 10 to 15 years. It is worth noting that management actually expects the plant to have a life of 15 years, even though it will be fully depreciated over 10.

A deal could be announced at any time between now and the June 9th deadline of the exclusivity agreement. The last meaningful hurdle, Expedited Project Review (EPR) approval, has been cleared as of last week. It should be noted that, per expert calls, an EPR is not the sort of thing you file unless you have a specific need to meet a shovel-in-ground date. MISO’s bandwidth is under extreme strain, and projects that aren’t crucially important are discouraged from pursuing EPR approval; nor is MISO likely to give this approval without serious need.

Although the approval was granted in a recent meeting, the website has not yet been updated to reflect this approval. Here’s what we see for Merom’s EPR:

Here’s what you typically see on the MISO website for an approved request:

And here is a slide from MISO’s 4/16 EPR review summary, confirming approval:

There seems to be a delay before the website is updated, but I believe most market participants simply track the website. Supporting this is that it is trading similarly to other small-cap coal names, with no significant jump post-approval:

Obviously, MISO approval itself is a prerequisite, but not a guarantee. But further increasing my confidence is the fact that actually makes a lot of sense for a hyperscaler to partner with Merom:

Indiana is a great place to build data centers due to regulatory and business incentives, attracting a combined $13.8B worth of build-outs from Amazon, Meta, and Google.

Simultaneously, MISO is facing a capacity shortfall, and there is no reasonable nuclear capacity that can come online—as Hallador IR put it, Merom is “the only game in town”.

Management has highlighted their partner’s capital commitment: “our partners' additional large-scale financial commitments to third-party stakeholders necessary for the transaction, highlight the meaningful progress that we feel we've made towards finalizing a definitive agreement within our exclusivity period”.

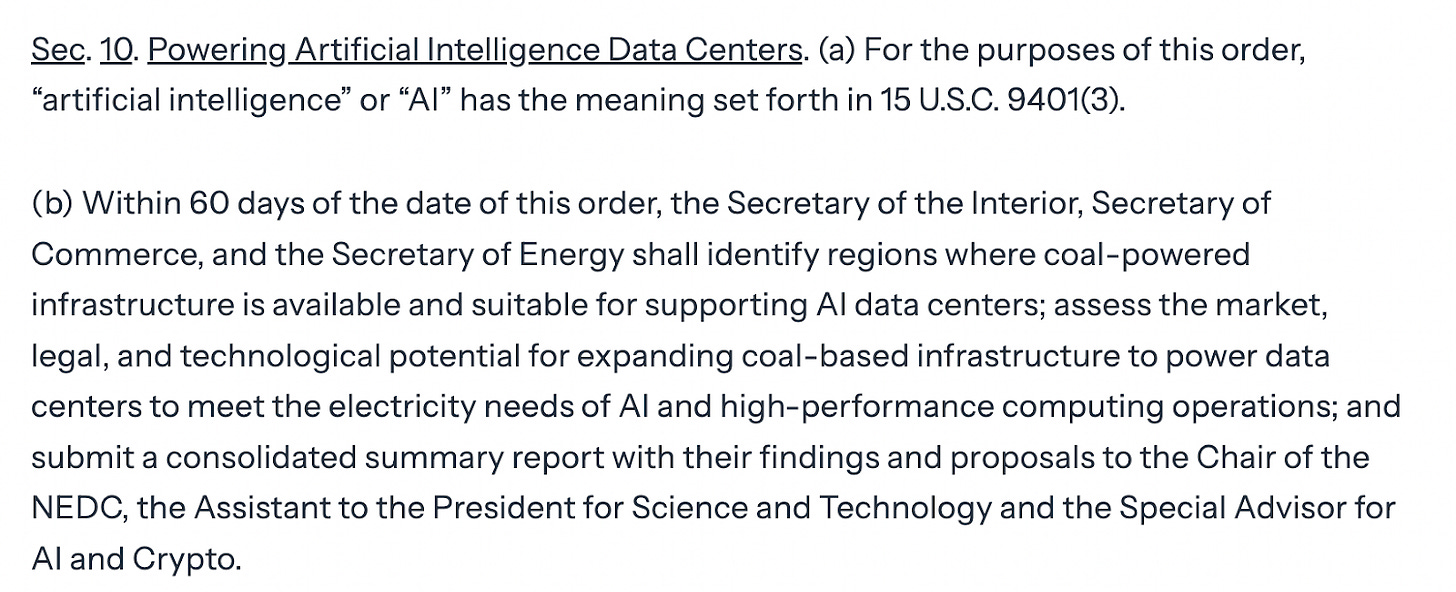

Importantly, the Trump administration is explicitly advocating for and deregulating coal-powered data centers, decreasing headline risk.

Merom’s energy is “front of meter” — energy generation that is connected to the grid and potentially mixed with other sources, such as natural gas, wind, or solar, again decreasing headline risk.

What would Hallador trade at if it became an IPP? Management breaks out Power and Coal with distinct P&L, and shares contracted volumes, prices, capacities and hedging profiles. We know:

Pricing: Assumed premium to the electricity curve at the time of the January agreement, estimated at $60-$70/MWh

Volume: The client is expected to take up nearly all available capacity, ramping up to utilize the full ~6GW

Duration: Expected to be a 10-15 year contract. Management believes that the plant has a remaining useful life of 15 years (though it will be fully depreciated w/in the next 10), and the recent press release specifies a minimum of 10 years.

Hallador could generate $200-250m of run-rate EBITDA on the Power Division alone versus a current market cap of USD600m with 0 net debt. Note that this is not ascribing any value to the legacy coal operation, which represents free optionality. A deal would give:

A long-dated contract

Maximum visibility around the entirety of its energy offtake given the fixed price

A fully integrated IPP model that would provide 90% visibility around its cost base

Sufficient coal supplies and diversified sourcing to power its coal-fired plant

Free optionality around the coal division earnings

Currently Hallador trades at around 2.5x EBITDA. It could reasonably be closer to 8-10x post-deal.

Per IR, if the deal closes, they will be hosting a dedicated investor call to talk through what this means for the company. There will be little uncertainty in the market about the magnitude of what a deal means for the company. I’d think that post-deal, the share price should immediately be 20-25+ and then likely grind higher over time. A 40-50+ share price would reflect the above EBITDA multiple.

What’s the likelihood of this getting done? One should make their own assessment, but assuming an eventual $45 share price, and that the entire business is a 0 without this deal (an absurd assumption), the current market-price implied odds are something like 30% probability. That stands in contrast with everything we’ve been hearing from management and with the recent EPR approval:

Staus Quo Scenario - Coal Company

Even without an IPP deal, Hallador is not richly valued. While coal names historically have had a massive obsolescence overhang, Trump’s recent executive orders have significantly extended the useful life of coal assets. There has even been specific attention paid to coal powered data centers:

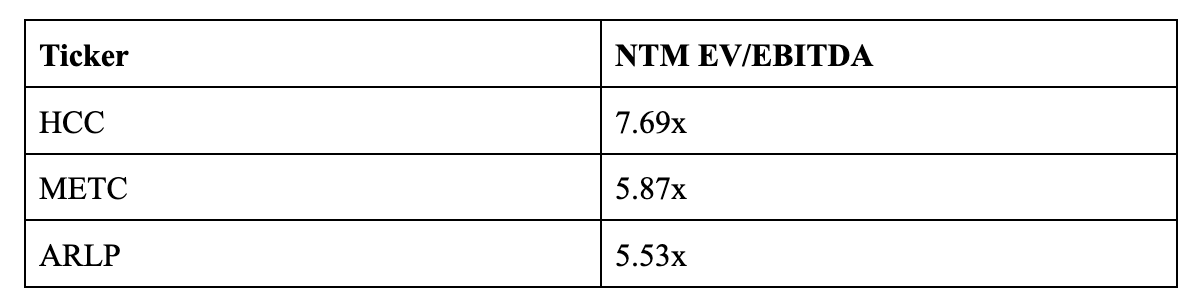

Due to a $215m one-time writedown of Sunrise Coal (which, by the way, further seems indicative of the IPP scenario), EBIT was temporarily negative. But EBIT from current operations is likely around a 100m run-rate. The company trades at a price implying a 2.5x run-rate EV/EBIT. A $500-600m EV would be fair under normal circumstances, given where comps are trading:

There is an argument to be made that domestic resource names are now somewhat of a macro hedge. There’s been significant tension around Canada-US energy escalation and tariff protectionism. A fully-domestic power producer, without any significant supply-chain dependencies, could receive a premium over historical multiples in this environment. It’s hard to give this an exact number, but it’s certainly significant. Hallador’s current $580m market cap is essentially fair for the base case scenario, but does not price in a transformative IPP deal whatsoever.

Risks

Exclusivity period extension

This is always a worry—even if the deal gets done, it may be delayed. For a hyper-scaler, paying more to extend the exclusivity period is not consequential.

The likelihood of a delay could also be increased due to supply chain issues which would delay the shovel-in-ground date for building the data center.

However, with power delivery first planned for ‘26, it doesn’t seem to make sense to delay the decision.

Environmental Protests

There’s always a worry around headline risk for a coal-plant, but we’ve seen precedent from hyperscalers. Additionally, Indiana is a deep-red state, and Trump is the most pro-coal president we’ve had in decades.

Poor Capital Allocation

Given the lack of net debt and the certainty around cash flows that a deal would provide, management has shared that they may well lever up and pursue M&A.

This would decrease low TV risk, but also could be received poorly by the market (depending on what deals they pursued).

Management has been recondite about exactly what they would do, and simply states they would address this at a post-deal investor call.

Cancellation

This would be a major issue for Hallador’s stock. It would be very hard to trust management again after their messaging, though they state that they’ve had other suitors.

We’ve also seen recent market research indicating a cooling of the data-center buildout story (albeit mostly internationally).

Yet, 3 hyperscalers remain active, and essentially a 4th will be joining via Stargate. It’s interesting to see how the highlighted portions of this note could actually be read as bullish for a plant like Merom.

Conclusion

Coal may not actually be “beautiful” or “clean”, but Hallador provides a concrete blueprint on how to best position an undesired low-multiple business into one that generates value exploiting the intersection of many crucial policy priorities such as AI or energy independence. This normally results in a significant re-rating and value creation. With MISO approval, the last meaningful regulatory hurdle has been cleared.

In times of uncertainty, it makes a lot of sense to reallocate to catalyst-driven ideas. Further, it makes sense to prioritize near-term catalysts where the timeline to playout has compressed. Finally, one would seek out potential domestic beneficiaries of tariff and energy tensions. Hallador is all three.

I believe on deal announcement we see an immediate jump to $20-25, and then simple execution could see the stock trend up to $40-50.

How are you thinking about the recent news of cancelation of exclusivity?

If they really are the only game in town, this would be opportunity to add if it continues falling or do you see it different?

How strange. We featured Hallador for our readers also. Our investment playground is usually London’s junior markets or Australia.