Inflecting Drone Company w/ Near-Term (+300% vs. -30%) Binary Event ($RCAT)

Strong organic growth, regulatory tailwinds, and potentially transformative near-term contracts make Red Cat an appealing "GARP with catalyst" play.

The Company

Red Cat ($RCAT) is an Utah based manufacturer of small defense drones. They are the only public U.S. small defense drone manufacturer capable of large scale production. In September 2021, Red Cat acquired subsidiary Teal Drones. Teal is Red Cat’s primary revenue driver, and one of two remaining candidates for a $600m - $1b+ DIU contract. The company sits around an $85m market cap at time of writing.

Teal was founded by “drone prodigy” and Thiel Fellow George Matus who is one of the foremost U.S. drone engineers. He founded Teal at age 17 and has earned numerous drone-related patents. Teal joined Red Cat for the access to capital and the regulatory network necessary to compete in a market dominated by large government contracts. Red Cat specializes in the sorts of small drones used in reconnaissance and munitioned in conflicts like the Ukraine war. This war has demonstrated the need for both protectionist legislation supporting U.S. drone companies and stimulatory DoD spending.

The thesis hinges on several factors.

Drones are the future of war

Politics and security concerns will spur significant onshoring of drone production

Relatedly, Teal has a >50% chance of winning a $600m - $1b contract

This would be transformative for the stock price yet downside is limited by the company’s undervaluation and organic growth in a “business as usual” scenario

The next two sections focus on drones from a philosophical and geopolitical angle. These may be interesting but readers can also skip to the “SRR T2” section for more specific research on $RCAT.

Drones Are The Future of War

On July 9th The Daily dedicated an episode to the ways in which drones have revolutionized combat in Ukraine. The same day, the US government blacklisted Autel, a major Chinese drone company. There is consensus among industry experts—and the DoD—that drones are the future of combat, and that U.S. drone companies need support. Elon Musk summarizes:

The terrifying reality of drone combat can only really be understood through watching real videos such as those on r/combatfootage (viewer discretion advised). But the individualized drone attacks shown there are just the first wave. Consider this video of a DJI drone swarm. Note: DJI is a major CCP-subsidized drone company.

Even now, drones are able to autonomously go on combat missions, identify targets, and strike. These small drones are nearly noiseless, essentially cannot be shot down, and are nearly impossible to avoid. Having talked to multiple OSINT experts, defense industry experts, and several soldiers, one comment particularly stood out:

“Drones are the biggest military innovation since the machine gun.”

The Geopolitical Drone Landscape

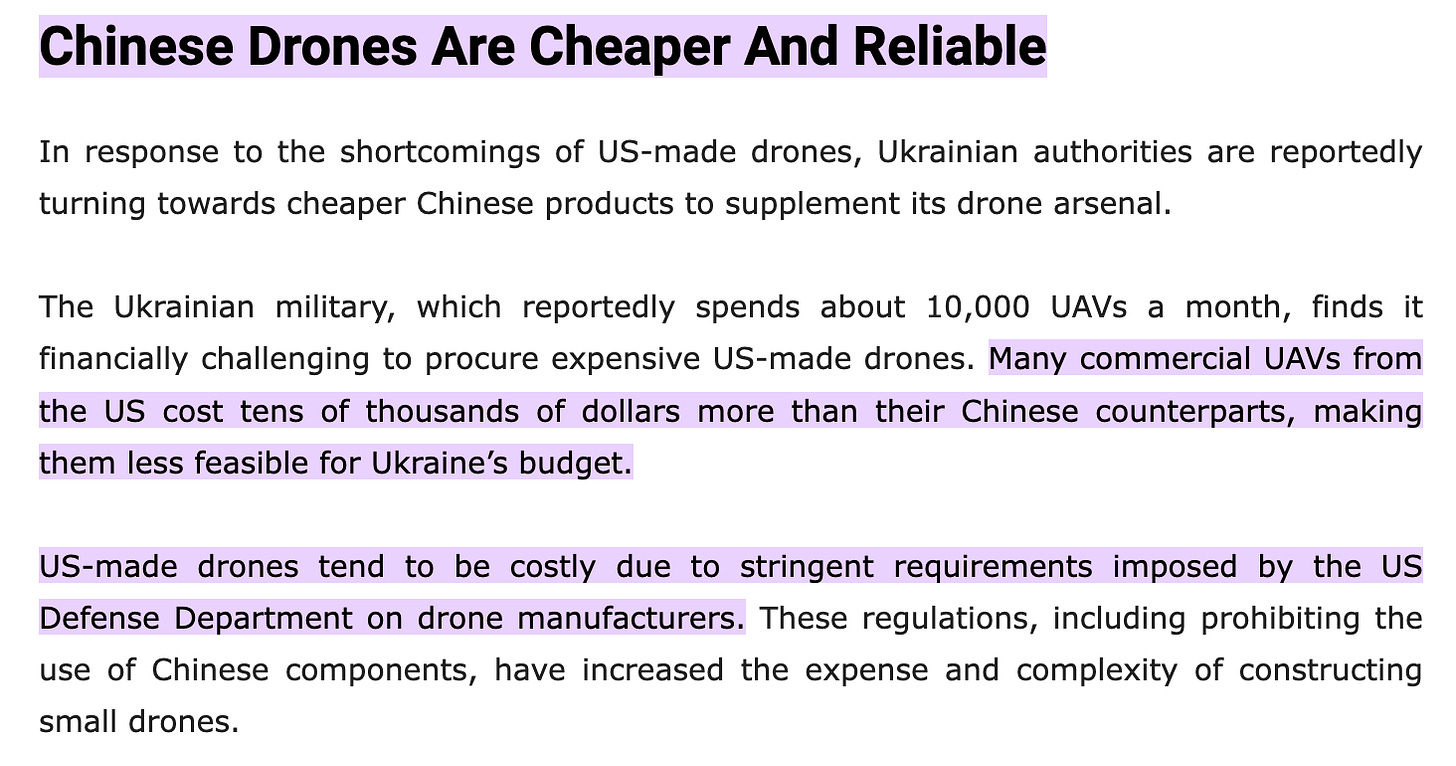

Chinese drones are currently attractive to combatants as they are cheaper, more reliable, and available in greater supply than Western options. America has been losing the drone race.

This is a major security concern. If drones are the future of war, a burgeoning defense industrial base for their production is a key strategic initiative. Chinese companies like DJI currently manufactures 3/4ths of the world’s drones. This is in no small part due to CCP subsidization.

The U.S. and allies cannot simply rely on foreign drones as doing so introduces security considerations. For example, as military drones are inherently expendable, secure supply chains are a necessity. Imagine a Chinese invasion of Taiwan: if the US and allies relied on Chinese made drones, it would be at the mercy of China after initial stockpiles were utilized.

Additionally problematic are concerns with malware, jamming, and spying capabilities. On January 16th, the U.S. Cybersecurity and Infrastructure Security Agency (CISA) released a memorandum raising these concerns w/r/t foreign drones, stating:

“Our nation’s critical infrastructure sectors, such as energy, chemical and communications, are increasingly relying on UAS for various missions that ultimately reduce operating costs and improve staff safety. However, the use of Chinese-manufactured UAS risks exposing sensitive information that jeopardizes U.S. national security, economic security, and public health and safety…”

“Without mitigations in place, the widespread deployment of Chinese-manufactured UAS in our nation’s key sectors is a national security concern, and it carries the risk of unauthorized access to systems and data,” said Assistant Director of the FBI’s Cyber Division, Bryan A. Vorndran. “The FBI and our CISA partners have issued UAS guidance in order to help safeguard our critical infrastructure and reduce the risk for all of us.”

Bipartisan political efforts have been introduced to remedy the situation. Contained in the Defense Budget for this year (NDAA 2024) was the language of the “American Security Drones Act of 2023”, which makes it so US Government agencies cannot purchase foreign made drones. As part of this Act, the U.S. government explicitly states a secondary goal of accelerating the development of the U.S. drone industrial base.

Recently, the House passed the “Countering CCP Drones Act” which will likely be signed into law as part of NDAA 2025. This utilizes the ability of the FCC to regulate airwaves to ban DJI/Chinese/foreign drones from using US controlled frequencies. Essentially this destroys the Western consumer market for DJI drones. This would serve as a major blow to Chinese companies, given that the consumer drone market heavily subsidizes the defense/enterprise drone market.

The U.S. Gov is well aware of the drone-first future of war and is highly incentivizing American drone companies beyond protectionist legislation. It has introduced two large programs of record. Participation in either would be transformative for Red Cat.

“So what do all these things -- what do all these regulatory tailwinds mean? Well, it means that the largest drone manufacturer in the world, whose #1 market with the United States, can no longer by law be bought by anyone that receive Federal dollars. It's not just the Department of Defense, it's local groups, it's fire departments, it's anyone that receives Federal dollars. This has created a very large market, a very large vacuum for only us and one other manufacturer in the U.S. that can build at scale to fill. So this is a very unique opportunity that doesn't always happen.” - Jeff Thompson, Red Cat CEO

SRR T2

The US Gov’t introduced the Short Range Reconnaissance program (SRR) in order to provide lightweight, backpack carry-able drones to troops. Key objectives include enabling real-time intel gathering, scouting potential threats, and interoperating with other army systems. SRR was initially divided into three tiers known as T1, T2, and T3. T3 was subsumed by T2 as the need for accelerating production became clear. T2 is now a massive contract including over 10x the drone systems as T1. It’s not clear what the precise dollar amount will be. T1 paid out $20m upfront and included additional purchases rising to $100m value over five years. Per T1, the average cost per SRR system was around $40k.

T2 is for approximately 12,000 systems:

Given advances in the Army’s needs and in drone technology, T2 systems will likely be costlier. According to West Point research, the cost may rise to around $60k/drone, keeping in mind that one “unit” contains two drones:

This would represent a total contract value of around $720m. It’s possible this number is low, considering T1 seemed to include payments beyond the unit costs of the drones themselves. The initial T1 $100m contract was for 1,083 drones. Straight-lining, T2 would reach over $1b. In any case, it is almost certain that the upfront payment alone would near Red Cat’s $85m market cap, and the total contract value would be several multiples larger.

Red Cat did not win T1. Teal had not yet been fully integrated as it was only acquired in ‘21, just one year before the award. Red Cat had not yet built its large scale factory, meaning that the government could not evaluate its production capability. However there are strong reasons to believe Red Cat will win T2—while at a mere ~$85m EV.

Red Cat vs. Skydio

Out of 37 original competitors for T2 only Red Cat and Skydio remain in contention. At first both companies appear difficult to distinguish. Both operate in the small drone space, have competed for similar contracts in the past, and claim defense expertise.

However, having talked to Teal CTO George Matus, several drone experts, and numerous end users, distinctions emerge. It’s important to note that the following points seem to contradict Skydio’s flashy online messaging and stellar web design (areas where Teal could do more). Regardless, the below points are summaries of conversations with real experts and end users.

Skydio’s drones are not custom-built specifically for SRR T2 leading to engineering challenges…

Skydio’s drones have fallen prey to signal jamming in Ukraine rendering them effectively unusable

Skydio uses Jetson NVIDIA chips which have had numerous security risks highlighted by the DoD

Red Cat’s T2 drone specs are not publicly disclosed, but their most recent Teal 2 model weighs around 2.75 lbs

In contrast, assuming T2 has similar weight requirements to T1, Skydio’s drone is significantly over the target weight limit:

Skydio drones are a “black box” relative to Red Cat

Skydio’s products are not as interoperable or customizable and they do not focus on collaborating with other drone companies in meaningful ways

Red Cat sees drones as “customizable platforms” akin to how an iPhone hosts numerous apps, resulting in a focus in interoperability and cooperation with other companies borne out by significant initiatives

Red Cat is “defense focused” whereas Skydio sees itself as an all-purpose enterprise drone manufacturer

Per conversations, a majority of Skydio’s revenues presently seem to be primarily from law enforcement, border patrol, bridge inspection, etc.

In contrast, Teal’s drones are purpose-built for the DoD / defense / NATO allies and they exclusively target the defense niche

Skydio’s reputation has soured significantly after poor performance in Ukraine

Skydio’s X2, which was shipped to Ukraine as part of T1, has performed very poorly in actual combat

Talking to industry experts, it becomes clear that Skydio’s drones often struggle to fly at night. Over 90% of missions are nighttime missions.

This stands in contrast to Teal which focuses on “dominating the night”

“The general reputation for every class of U.S. drone in Ukraine is that they don’t work as well as other systems,” Skydio Chief Executive Adam Bry said, calling his own drone “not a very successful platform on the front lines.”

Ukraine has largely abandoned Skydio drones in favor of Chinese made options from DJI

Skydio claims they’ve learned from their shortcomings and states that their Skydio X10D incorporates these learnings (the X10D is Skydio’s T2 drone submission). Whether or not this is true is hard to determine, but it is clear that T1 was an abject failure. It doesn’t seem likely such a failure would be rewarded, but as the incumbent, it is possible.

There are certain “clues” which may provide more clarity. For example, Blue UAS certification—a “check mark” for drone purchase by any U.S. Gov agency—was achieved by Teal 7 months ahead of Skydio w/r/t each company’s SRR T2 drone. Purchasing for Ukraine and for other allied countries can only include Blue UAS drones; this is “table stakes”. Since both companies submitted drones around the same time, the approval delay may indicate initial issues with Skydio’s submission.

In terms of production capacity, Teal has finished its factory buildout over a year ago, so this is a diminished compared to T1. The factory is 25,000 sq. ft. wholly owned facility in Salt Lake City, UT. Per CEO Jeff Thompson, Teal is producing hundreds of drones monthly and have the ability to quickly scale to thousands.

“The facility in Salt Lake City is in full mass production mode. We are running 1.5 shifts to meet production as we continue to invest in facilities, people and processes. We are demonstrating we can build tens of thousands of drones yearly.”

SRR T2 is an effort spearheaded by the DIU, a subdivision of which appears to make the final call. The DIU Director, Doug Beck, has an extraordinary resume (seriously, take a look). His organization would want to see the warfighter equipped with the best possible drone. All the decision makers will likely be veterans and high integrity people. For this reason, it is likely that the best drone will win. RR T2 will have a winner announced in September 2024. This is likely a winner-take-all contract.

Skydio has:

Performed terribly when it mattered most…

Is not solely defense focused and…

Has not custom built a drone for this initiative.

There is a strong chance Red Cat wins this completely transformational contract.

Replicator Initiative

The replicator system is a Pentagon initiative which unveiled a “radical new strategy focused on fielding thousands of cheap, smart and autonomous war drones across multiple domains” within the next 2 years. It is largely a response to China’s aggression regarding Taiwan. Overall this program has the potential to be significantly larger than even SRR T2 as it would likely be a yearly, recurring purchaser of drones.

In ‘24, $500m was allocated for replicator the same amount has been apportioned for ‘25. However this is a highly confusing initiative and it looks as if there aren’t as clear public deadlines for the projects it contains. For that reason it is a bit harder to value. Red Cat believes that it may win a large contract for this initiative which would likely be announced by September:

“The Replicator program, which is expected to include over a $1 billion budget across several tranches, is focused on fielding thousands of attritable systems, including small UAS. Revenues continue to grow as we expand our customer base domestically and internationally. We have sold our products to customers in over 10 different countries.” - CEO Jeff Thompson

Finally, it should be noted w/r/t these programs of record that Skydio has spent hundreds of thousands in lobbying efforts. There is therefore a worry that these contracts will not be awarded entirely based on merit. This is unfounded. First, much of Skydio’s lobbying efforts were centered on ushering in the ASDA and currently on supporting the Countering CCP Drones Act. These acts effectively eliminate DJI as their competition for all enterprise applications, which again appear to currently contribute the majority of Skydio’s revenues.

Financials

Evaluating Red Cat financially is best done by examining two eventualities (Replicator/SRR T2 win vs. business as usual) to determine the upside/downside. Let’s examine the business as usual scenario.

As seen above revenues have begun to grow exponentially. This is due to the success of the Teal 2 drone. Lasts quarter’s revenues were $5.85 million largely driven by Teal 2 sales. Red Cat believes Teal 2 is becoming the “small drone of choice” for the DoD and “over 10 NATO countries”. It is unlikely that sales will slow based on the state of the world and increasing demand.

Assuming no SRR or replicator win, Red Cat will achieve cash flow breakeven in ~2 years on the strength of the Teal 2 drone’s success. Current cash needs are decreased since the company’s factory buildout and SRR T2 R&D have been completed. Red Cat recently raised $3m cash and has a call option via several million shares of Unusual Machines ($UMAC). Unusual Machines was a Red Cat spinout which produces drone parts like rotors. Though illiquid, Red Cat’s ownership is valued at around $7m. Red Cat currently has ~$4.1m of quarterly cash burn.

Gross margins appear poor at first at ~18%. However this is a function of sub-scale production. As drone companies like Teal must stockpile chips and invest into factories and labor to be prepared for contracts, they have fixed costs which do not scale with revenues. Margins improve drastically when larger orders arrive. The company foresees 50% gross margins when operating at scale. Drone companies cannot simply make a large order in anticipation of an eventual contract, because these contracts have custom specifications.

Assuming quarterly operating expenses of $5.5 million and expected margin increases to 50% as Teal 2 sales continue, Red Cat reach profitability at ~$11 million in quarterly revenue. Last quarter’s margins were deceptively low due to non-recurring engineering costs for Teal’s custom SRR T2 drone candidate. The company believes that it will be able to achieve 70%+ margins for many drones that come with certain additional features and/or software packages.

Given the engineering quality of Teal and Red Cat and the ongoing trend towards smaller, attritable drones, Red Cat is exciting even in a “business as usual” scenario. It should eventually achieve a major program of record and, in the meantime, strong organic growth will continue, likely allowing for positive earnings and cash flow breakeven within 2-3 years if not sooner.

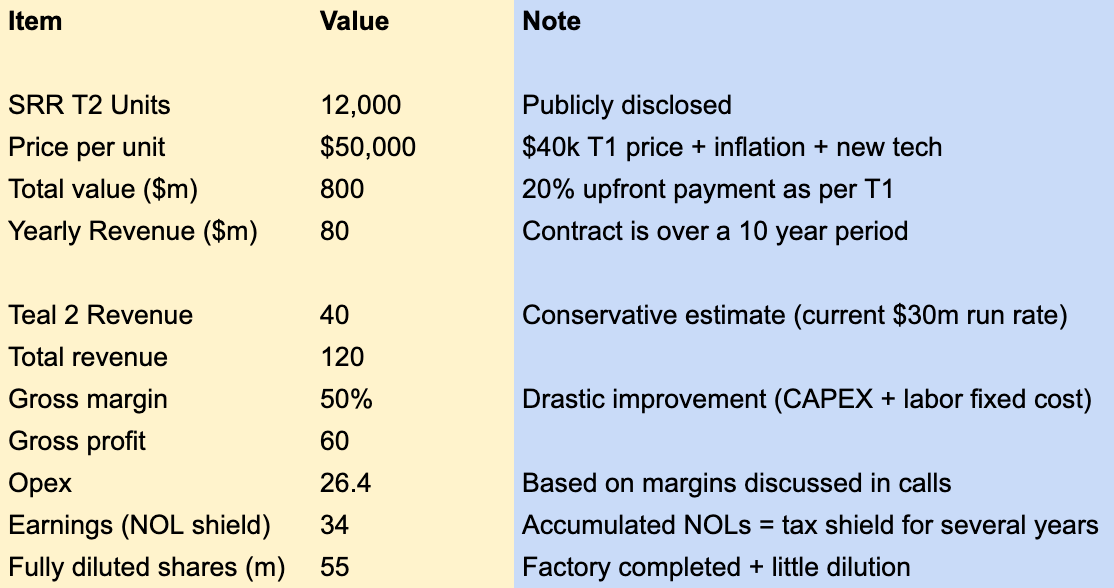

In the case of an SRR win, the financials drastically change to the upside. This is a quick summary of a reasonable scenario. It should be noted that due to a lack of clarity around pricing that these numbers could all be +/- 20%:

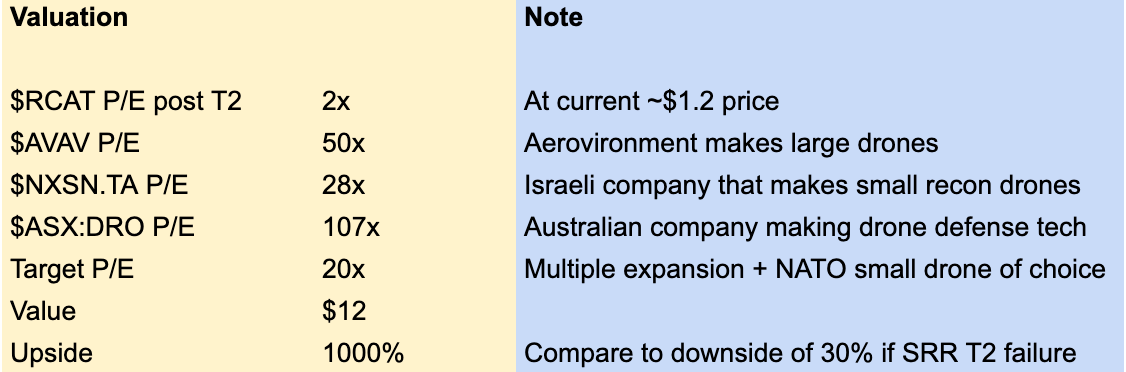

Valuation and Comps

If Red Cat revenues reach $120m/year in revenues post T2 the same multiple as today would yield something close to $12/share. Even half these revenues, returns are appealing. It should therefore be clear that Red Cat’s current revenue multiple of 5x LTM revenues is too low prima facie let alone accounting for the possibility of a blue sky outcome.

Red Cat is a unique asset on the U.S. markets as the sole public small drone defense stock. The closest comp is obviously Skydio. Skydio trades at a 21x revenue multiple. Applying a similar multiple to Red Cat pre SRR would imply a $4.2 stock price today. It’s not clear that Red Cat’s revenues are substantially lower than Skydio’s but halving this multiple would imply a $2.1 price.

If you do not just look at last year’s revenue and instead straightline last quarter’s (reasonable given Teal 2 drone revenues are growing at 45% QoQ) the company is essentially at a $30m revenue run rate. They’ve gone from 0 to $30m in 12 months (!). Assuming there’s again 50% revenue growth in 2025, revenues would be at around $45m at EOY F2025. This would give a share price around $11. Halving this multiple to account for Teal’s relatively smaller non-enterprise opportunity set compared to Skydio’s would still yield a price >$5/share.

Why the Opportunity?

Red Cat has been cast aside by the market due to several factors.

Technical Complication / “Too Hard” Bucket

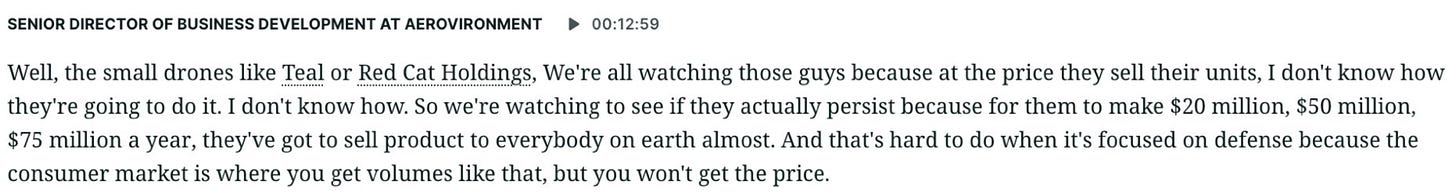

There is a high level of technical complication when it comes to understanding the story. Most are unaware of the implications of, say, Blue UAS certification, or are unfamiliar with the SSR or Replicator programs. This extends even to industry experts so it certainly extends to most market participants. Take the following recent Tegus call with a former AeroVironment ($AVAV) employee who misunderstands numerous points.

This is a strange point considering Teal’s revenue is at a $30m run rate without SRR or another large program. Clearly SRR would get Teal to the higher bound of these numbers. It is already at the lower bound…

This would be a good point, but it completely overlooks that both Skydio and Teal have over 100 employees. The sophistication of these companies is mischaracterized. Further, both are Blue UAS certified, so security concerns have already been addressed.

Once again, this is patently not true. See the following—Replicator is funded for ‘24 and funding is being secured for ‘25.

Concerns About Burn

Burn and dilution have also been a continual concern (as discussed in the prior section). There was historically substantial CAPEX spend. However, when we spoke, George Matus emphasized that they are completely ready to go. Their factory is a wholly owned 25,000 sq. ft. facility in Salt Lake City currently producing hundreds of drones/month, with levers to produce thousands e.g. in the event of a contract win.

Additionally, absent large contracts the company would likely have to dilute again, though likely not until 2025. It is also unlikely that it would dilute if it were to reach cash flow breakeven which mathematically would occur in 2 years off of Teal 2 drone sales alone. Employees and executives hold 40%+ of the stock so they incentivized to avoid dilution.

Anti-Mandate and Anti-ESG

Mechanically, another reason for mis-pricing is that the company is a micro-cap and as such is not suitable for most institutional investors, who are commonly unable due to mandates to invest in stocks under $100m. Relatedly this means that few analysts cover the stock. To date, only ThinkEquity and Landenburg have regular coverage, the latter of which has only recently initiated.

Similarly are often ESG concerns preventing larger organizations from purchasing drone stocks. Unlike DJI, which pretends not to know what its drones are used for in its corporate messaging, Red Cat has embraced its place on the “killchain.” Even if they do not manufacture the payloads themselves, they are undoubtedly the delivery mechanism for munitions.

Fatigue

By far the largest reason for the discrepancy between price and opportunity derives from investor fatigue. For years American drone companies were “just a few quarters away” from large contracts or from competing with DJI. This has changed with recent legislation and the war in Ukraine. The U.S. has understood the need for a strong drone defense base and is taking measures to secure one.

Risk Factors

There are three major risks stand out. While not effecting SRR or Replicator catalysts which should arrive this fall, these factors may present moderate headwinds going forward.

Trump Presidency

It appears probable that Trump is reelected. In his own words, Trump intends to majorly reform if not leave NATO. He also intends to sell out Ukraine to Russia. Respectively, these actions would complicate allied purchases of small American drones and reduce their near-term demand. Whether he actually follows through remains to be seen. Nevertheless Trump is doctrinaire on protectionism and is strongly anti-China, so ultimately U.S. drone industrial base tailwinds would likely remain.

Over Acquisition

Second, it should also be noted that Red Cat CEO, Jeff Thompson, previously cofounded a company called Towersteam ($TWER) which currently trades over the counter. For a while it was quite successful—there are a few old VIC articles on the company—reaching a $300m market cap. Unfortunately the company foolishly anticipated higher SME demand for wireless access and accordingly acquired provider HetNets.

HetNets signed long-term leases and paid installation rights for various rooftops on which it would mount its cells. The company had interesting technology which helped improved cellular signals in dense urban areas through roof-mounted wireless “small cells”, but demand didn’t materialize. These leases and installation payments became a major drag. At the time of delisting HetNets contributed just 10% of revenues but contributed to over 50% of COGS. One may look at this history as a risk or a positive for $RCAT.

On one hand, failure is never reassuring; we’d prefer to bet on winners. On the other, it is noteworthy that Red Cat’s CEO has seen what failure at a tech-forward company looks like, and may be able to avoid some pitfalls. So far Red Cat has been more prudent about controlling costs. Conspicuously, the company did not invest in a factory buildout until the US Government passed anti-CCP drone legislation and until it became an SRR T2 finalist.

Further, given that Teal was an acquisition which now drives a vast majority of Red Cat revenues, it’s an oversimplification to view acquisition as bad in and of itself. However I was concerned to see that the company announced an LOI to acquire FlightWave Aerospace Systems. Red Cat has not filed an 8-k about this LOI so perhaps it won’t materially impact Red Cat’s financials; FlightWave seems to be a very small company. Yet with so many catalysts on the horizon, it may read as unfocused.

Direct Sales Could Be Even Stronger

One issue I am also thinking through is why Red Cat is not more aggressively pursuing direct sales to NATO allies. Of course, this speaks to the previous point about cost controls; they may want to avoid a large sales team buildout until their future has been securitized by a major contract.

Still, it seems that international sales are something which the company has messaged about for years, but which have always been “just around the corner”. It is unclear whether the company’s direct sales team can execute or whether Red Cat will rely on onerous large scale contract wins. Organic growth has been solid, but are they reaching out and taking market share?

Analogous Situations

When a government begins supporting a drone company, its stock price can rapidly appreciate. Governments are the best clients to do business with. They are price insensitive, mandated buyers who print their own money. Drone production economics—as discussed earlier—improve drastically once large production begins. The market is consistently slow to catch on to this as we’ve seen several times recently:

NextVision (NXSN.TA) which manufactures small drones and drone cameras. The company has undergone multiple expansion to a 31x P/E and has seen revenues explode with the war in Gaza, resulting in stock price going from $5 to $55 in a few years:

Droneshield (ASX:DRO) is another example. The company manufactures drone detection and protection equipment and saw revenues leap from $16m in ‘22 to $55m in ‘23 on the back of major governmental orders. It’s multiple climbed to 50x P/E:

Outside small-caps, AeroVironment (NASDAQ: AVAV 0.00%↑) has done well this year on sharply increased governmental demand. A portion of their revenues are actually from participation in the government’s Replicator initiative. For this initiative, AeroVironment is contributing its Switchblade drones; these are larger drones and do not place them into direct competition with Red Cat.

Once a company establishes a strong governmental relationship it is increasingly likely to deepen that relationship overtime, becoming entrenched spending. With Blue UAS certification it is highly likely that this would apply beyond just the U.S. Orders would likely begin from many NATO allies assuming Red Cat could establish a large program of record.

Conclusion

“Skate to where the puck is going, not where it is…” - Wayne Gretzky (apocryphally)

In terms of small defense drones, development and manufacturing is geographically and politically bifurcated. On one side there is China, with CCP-subsidized companies like DJI and Autel. These have been able to dominate the market by leveraging governmental resources and undercutting fair market prices. On the other, there are Western companies like Red Cat and Skydio. For years they have suffered from worse tech and higher prices.

The U.S. Government has thrown down the gauntlet. Recent legislation like the ASDA and the CCDA will be as consequential for U.S. drone companies as the CHIPs act was for U.S. semiconductor companies. Ensuring a drone industrial base that is able to compete technologically with China is a must in an increasingly fractious world. When the U.S. government embarks on an industrial project, companies can win big. Consider the EV subsidies which sparked Tesla’s dizzying rise.

Red Cat and Skydio are the only viable small defense drone manufacturers operating in the US. The former is solely focused on defense, a specialization which restricts its TAM but increases its ability to dominate a niche. The later is attempting to be all things to all parties. It is unclear which strategy will ultimately succeed, but Skydio has failed when it has mattered most, in Ukraine.

Red Cat is cheap from an organic growth perspective and is an interesting event-driven situation. It enjoys apparent superiority in meeting the demands of SRR T2. There is no guarantee that it will win. Skydio boasts substantial scale, funding, and lobbying advantages. However it is my assessment—based on conversations with industry experts, end users, and Teal CTO George Matus—that Red Cat’s drone would win out in a fair contest. Keep in mind that all available information points to the contract simply going to the company best able to fulfill the mandates.

If Red Cat wins T2 (or a significant Replicator contract), the stock will move several hundred percent within days to months, assuming the market parses the information and execution is solid. If Red Cat fails to win a program of record, it will nevertheless benefit from massive legislative and governmental tailwinds. Organic growth for the Teal 2 should continue apace.

I see an SRR T2 loss resulting in a 30% downside correction in the near term, which would nevertheless present an opportunity long-term. Teal will reach cash flow positivity within 2-3 years. Considering its relatively low revenue multiple, this achievement should allow the market to grow more comfortable and should result in a significant re-rating. This is an intriguing asymmetric scenario.

It is especially interesting given that no one on FinTwit, MCC, or VIC has even been tracking it, so a win may catch the market offsides.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered investment advice. Investing involves risk, including the potential loss of principal. The author holds a material position of the security discussed. The author is not a registered investment advisor and does not provide personalized investment advice. Always conduct your own research and consider your investment objectives and risk tolerance before making any investment decisions. The author and publisher shall not be liable for any actions taken based on the information provided in this article.

I enjoyed your writeup. I was curious about some devil's advocate ideas for why Red Cat may not win the contract and Claude gave me some ideas--sharing here in case it's useful to anyone: Here's an outline of the devil's advocate position for why Red Cat may not win the SRR T2 contract:

Incumbent advantage for Skydio

Skydio won the previous T1 contract, giving them experience and established relationships

The government may prefer continuity rather than switching providers

Skydio's broader focus could be seen as a strength

Their experience in various sectors (law enforcement, border patrol, etc.) may be viewed positively

Diverse applications could lead to more robust technology

Skydio's superior funding and resources

Larger company with more capital to invest in R&D and production

May be better equipped to handle large-scale government contracts

Potential bias in the article's sources

Information from Red Cat's CTO may be overly optimistic

Industry experts consulted could have incomplete information about Skydio's capabilities

Skydio's claimed improvements

They state they've learned from shortcomings in Ukraine

New X10D drone may address previous issues effectively

Lobbying efforts by Skydio

While the article dismisses this, lobbying can have significant influence on contract decisions

Production capacity concerns for Red Cat

Despite claims, Red Cat may struggle to scale up production quickly enough

Potential overemphasis on Ukraine performance

While important, this may not be the only or primary consideration for the contract

Red Cat's financial position

Smaller company with less ability to absorb setbacks or delays in payment

Possible overestimation of Red Cat's technological edge

The true capabilities of each company's drones may be closer than portrayed

Yep this is great to see