Insureco w/ Potential Strat Alts Announcement Soon + 100% Upside on Buyout ($TIPT)

Tiptree has a good chance of announcing within weeks that it is selling a major division which could represent $35-40/shr of value.

The below tweet sums up much of how I feel about the market right now. And to that end, it’s well worth looking more into special situations. Surprisingly, TIPT 0.00%↑ is a completely unfollowed name that may well officially announce a transformative sale process on its upcoming earnings call (estimated by Nasdaq to be after market on 2/26/2025, but unclear). In fact, it apparently has begun this sale process already, as I will explore.

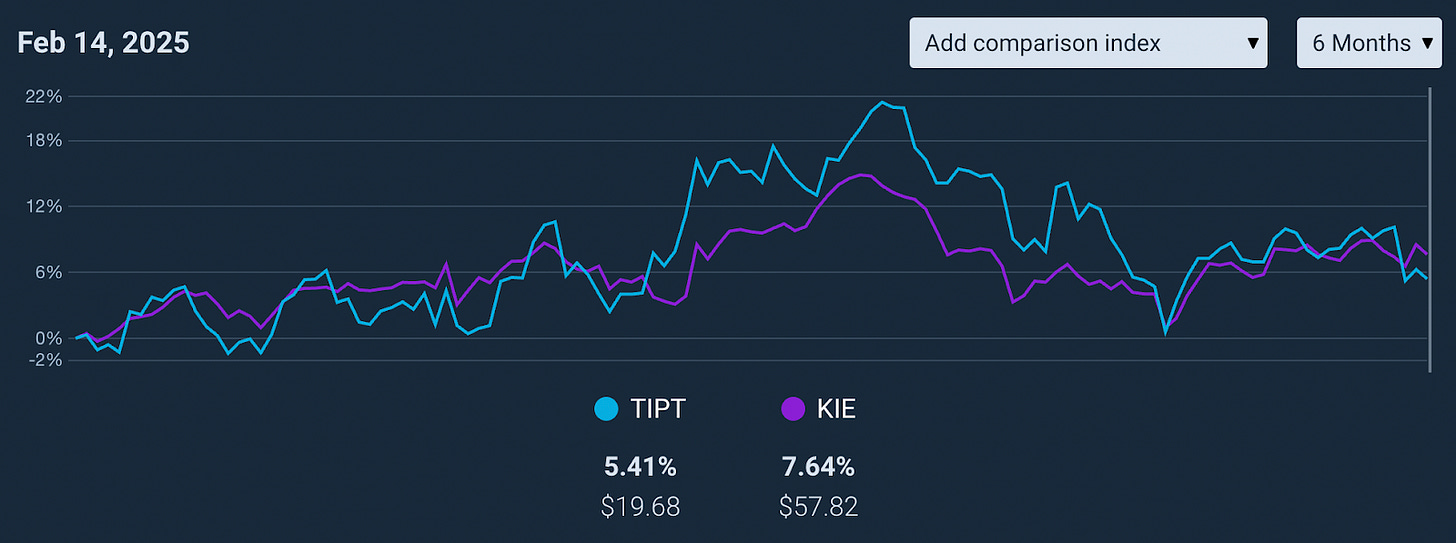

Additionally, we’ve seen recent outperformance in insurance names. This represents a flight-to-quality and a flight to uncorrelated cash flows. This makes a potential sale more attractive to both strategic acquirers and sponsors. With that context, let’s dive in.

I entered a position in Tiptree ($TIPT) calls and commons before the upcoming Q4 earnings call. There are two ideas here, with different expressions of risk/reward. The calls are a medium-risk, very-high reward idea. There is a largely binary catalyst: whether or not management discloses strategic alternatives (the reasons why they potentially will are discussed later). In the downside scenario I’d expect a loss of 30%+ as there’s not much IV priced in, and in the upside scenario, a gain of 300%+, which would be achieved by a return to the 52 week high of $25. I believe the probability is skewed towards the latter scenario. I would note, however, that a recent runup in the name has already taken these calls from 35c to 60c, so adjust these expectations accordingly.

Commons are low-risk, moderate-reward play. Commons present a fairly safe opportunity for an event-driven 25-30% return, with minimal near term downside. Tiptree is worth $30-40 on undemanding comps, but will not likely see that sort of value until Fortegra is spun out. In both cases I believe management will use the earnings call to announce a sale process of Fortegra. Fortegra is Tiptree’s insurance division and represents substantially all of the company’s revenues.

Background Reading: The “Strat Alts” Metagame

Occasionally companies will leak information that they are pursuing a sale to the news media. Other times, the news media simply reports on rumors. Typically, more legitimate sources (BB, WSJ, Reuters) are actually reporting based on information from companies themselves. In contrast, the Betavilles and Street Insiders of the world are often (but not always) reporting based on rumors and hearsay. Tiptree appears to have leaked to The Insurer that Fortegra, its insurance unit that drives almost all revenues, is pursuing a sale.

The Insurer is owned by Reuters and is a highly respected industry publication, supporting that this is coming from the company itself. The Insurer has been proven right on previous Tiptree-related exclusives. Finally, it is noteworthy that the publication reported which specific banks engaged to help the sale process, furthering the story’s legitimacy.

Why do companies do this?

The announcement helps to assess initial market reactions without a full commitment to the sale or to a certain timelines

Articles serve as a form of marketing and can help draw interest from additional strategic acquirers

Additionally, and most importantly, such news almost always has a positive share price reaction

Fascinatingly though, there has been absolutely no share price reaction to the recent news, and shares have merely traded in-line with the S&P Insurance ETF!

If the story had simply been broken in the WSJ, I would have expected a 25-30%+ jump based on comparable “scoops” and the company’s own share price movements based on precedent announcements. Because of the reasons explained below, it appears this news was simply missed. This is a case of a small cap name suffering from market inefficiency in the truest sense. Before explaining why this was missed, it’s worth looking at prior announcements from Tiptree and the market’s reaction.

Precedent Share Price Moves

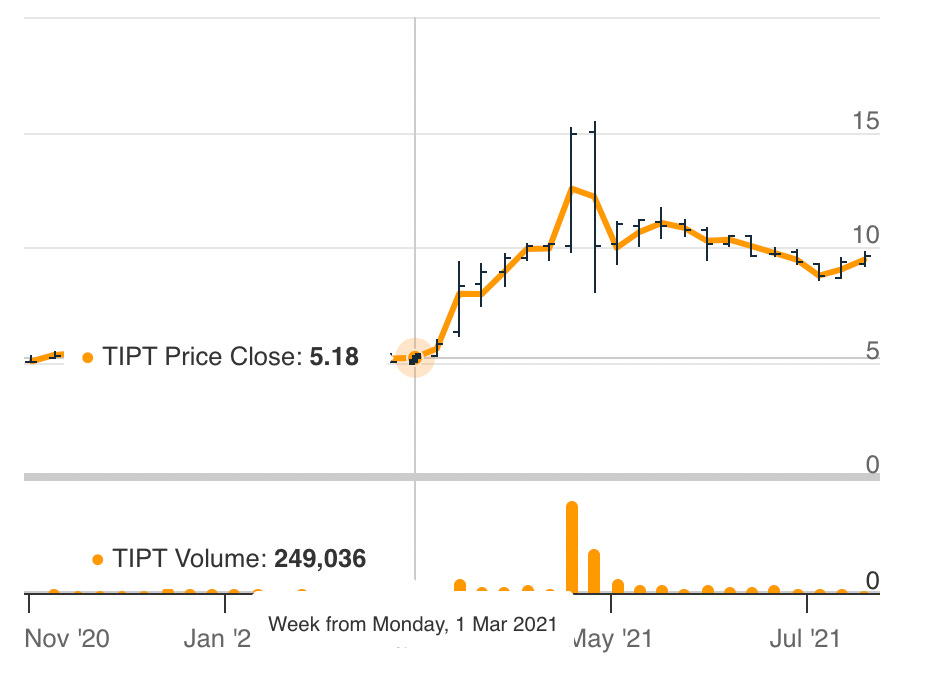

When Warburg announced its initial investment into Tiptree (and Fortegra IPO plans) in March 2021, the stock moved 300% over the course of several months. This coincided with a large spike in volume:

Later, when Warburg began marketing the IPO in October 2021, the stock moved up 50% in one day and 60% over the next several days. Again, there was massive volume.

Years later, when Warburg announced its intention to IPO a second time, the stock moved up 16% immediately, rising to a high of a 33% move over several weeks. The dip indicates the announcement that market conditions weren’t favorable to pursuing an IPO for appropriate value. This again shows market responsiveness to breaking company news:

So, Why Was This Missed?

We can see neither a large price movement nor a significant volume spike corresponding to the article in The Insurer, which deviates from the pattern we have seen three times previously:

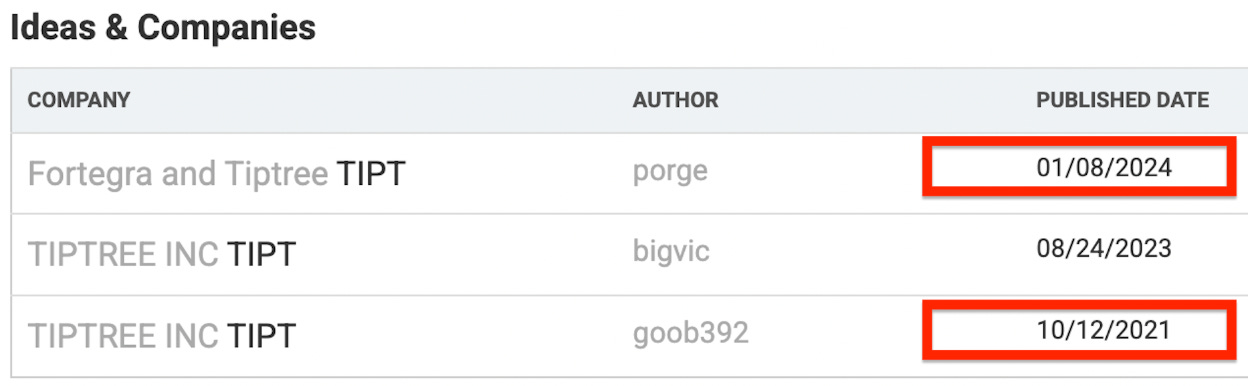

Both previous IPO attempts were announced via press releases, which are distributed widely over newswires. This means that there is a certain amount of exposure since many price-setters monitor newswires, and have flags on specific types of news, like M&A. Consider that two of three VIC writeups on the name have occurred immediately after Warburg’s initial marketing of the IPO, and the announcement of the second IPO attempt:

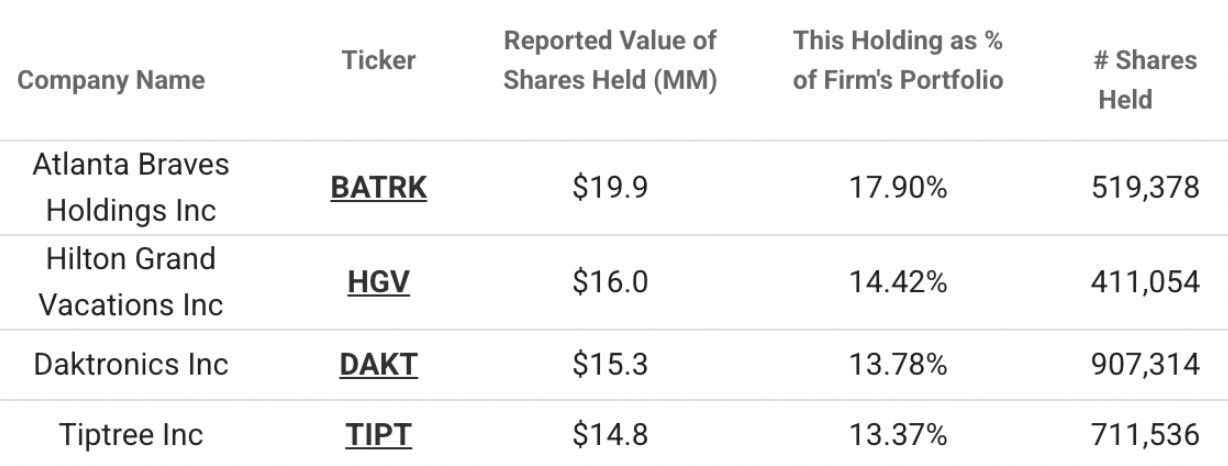

Normally, analysts would have picked up on the news, but this stock has no analyst coverage. Although there would also be marginal price setting from active investors, most investors are passive or insiders. The largest active manager invested in the name Breach Inlet Capital, which invests in small cap companies with “natural catalysts”, but BIC owns only ~2% of shares, and this is already a major holding; they would not likely size it up:

Obfuscating the announcement further is the lack of listed company being named in the headline:

“Fortegra hiring Barclays, BofA as it gears up for sale process following pulled IPO.”

It is unlikely that anyone not already familiar with the name would realize this is essentially a public company selling itself (given that Tiptree again is essentially just Fortegra).Additionally, I have confirmed this story does not appear on either Bloomberg or CapIQ on Tiptree’s page, further supporting the idea that it’s been missed.

Finally, and importantly, the metadata typically included with an M&A exclusive from Reuters was not included with this story, meaning that algorithmic buyers are likely unaware. I can confirm this given that I subscribe to the meta-data enhanced Reuters news-feed, as it is necessary for some of my quantitative strategies. The Insurer is owned by Reuters, but it clearly does not go through the same data-labeling process before stories are released. This further explains the lack of mechanical buying on the headline.

The thesis is therefore that management will speak to the sale process on the earnings call, and announce strategic alternatives. Given that The Insurer reported the timeline for the sale process to begin in February, and there has been radio silence so far, this would be the most natural time for an announcement to occur.

Valuation

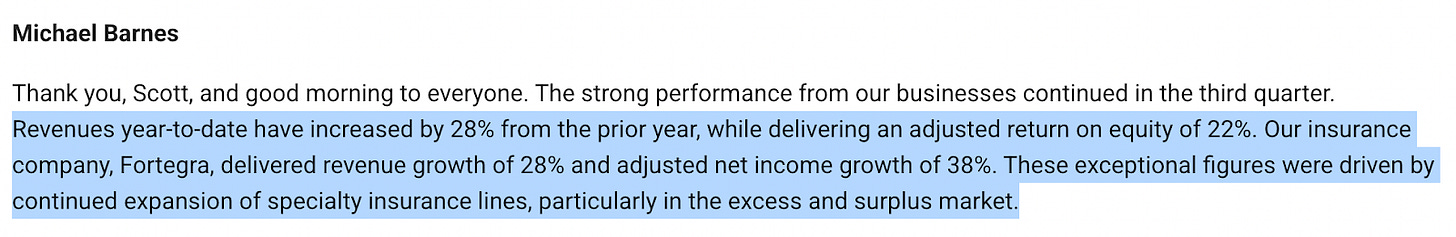

$TIPT owns Fortegra, which for all intents and purposes is the whole company (it sold off various assets over the years, so now this division contributes 95% of the company’s revenues). For this trade, it’s not actually too important to go into the minutiae of the business. Essentially Fortegra provides niche insurance products, particularly in E&S. The business has been executing better than nearly all comps over the last 5 years. This is a great overview from @BoujeeBanker on Fintwit. CEO Michael Barnes further highlights the execution story below:

In 2021, Warburg Pincus invested $200m in Fortegra for a 24% ownership stake, valuing the business at 13.5x EV/EBITDA or $833m. The plan was to IPO the business, but the 2021 IPO failed (despite a credible syndicate led by Goldman). Warburg wanted an insanely bullish valuation of $1.5 billion, despite Covid uncertainty and much higher hype around “tech-enabled” insurers like Lemonade. Another attempt at an IPO was pulled in early ‘24, due to market conditions.

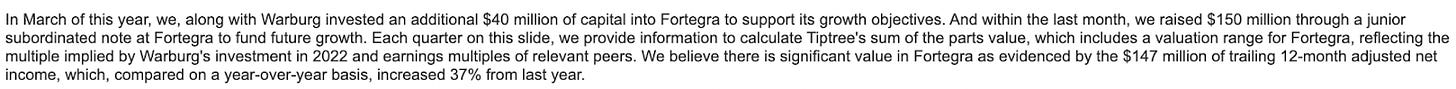

Since the initial IPO, Fortegra has executed, and has a TTM ANI of $147m, as of last November, per management. This was a 37% YoY increase!

Assuming in-line multiples to other specialty insurers—though a premium could be justified due to superior performance—this business could be worth anywhere from 15-20x on adjusted net income. Adjusted for Warburg’s ownership, this would be $1.2-$1.6B. An acquirer might pay towards the upper end of this range. Indeed, there are significant cost savings as management compensation is quite high. This would be a 70 - 100% premium over the current stock price. A sale would likely be for $35+.

Sale Incentives

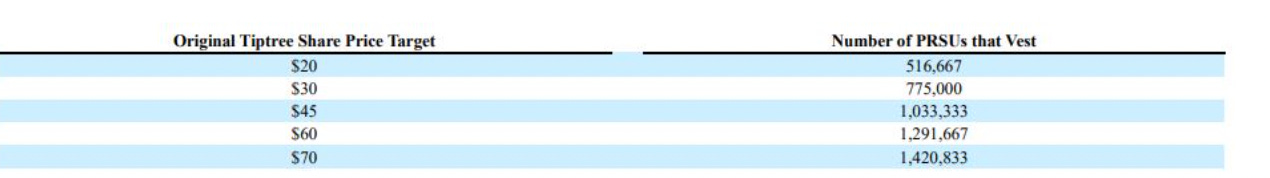

Frankly after the scars of these IPO attempts, I believe management will want to sell this business. Having executed well enough to have proven the story, it seems like self-interested management would now do well to pursue a large payday. Insiders are aligned, owning 34% of the business. Further incenting a sale are the following RSUs which would vest at various sale prices:

Importantly Tiptree has consistently traded with a significant hold-co discount. Now that the company is receiving 94% of revenues from Fortegra, it is no longer really a hold-co. Shareholders should be eager to capitalize on the potential for a higher multiple.

The other key insider is Warburg. It makes sense that Warburg initially wanted an IPO. Warburg wanted to retain some upside (e.g. sell some of its stake while keeping the rest). This optionality would likely have paid off had they completed an IPO, given how Fortegra has performed. However, with two pulled IPOs, it is likely now Warburg’s best option to simply pursue a clean sale. Note they would be choosing to waive their right for a qualifying IPO.

From a sponsor’s perspective, financial services are hot, there is high-demand for differentiated sources of return, and regulatory concerns are significantly diminished. Private equity investment in financials is near an all-time high.

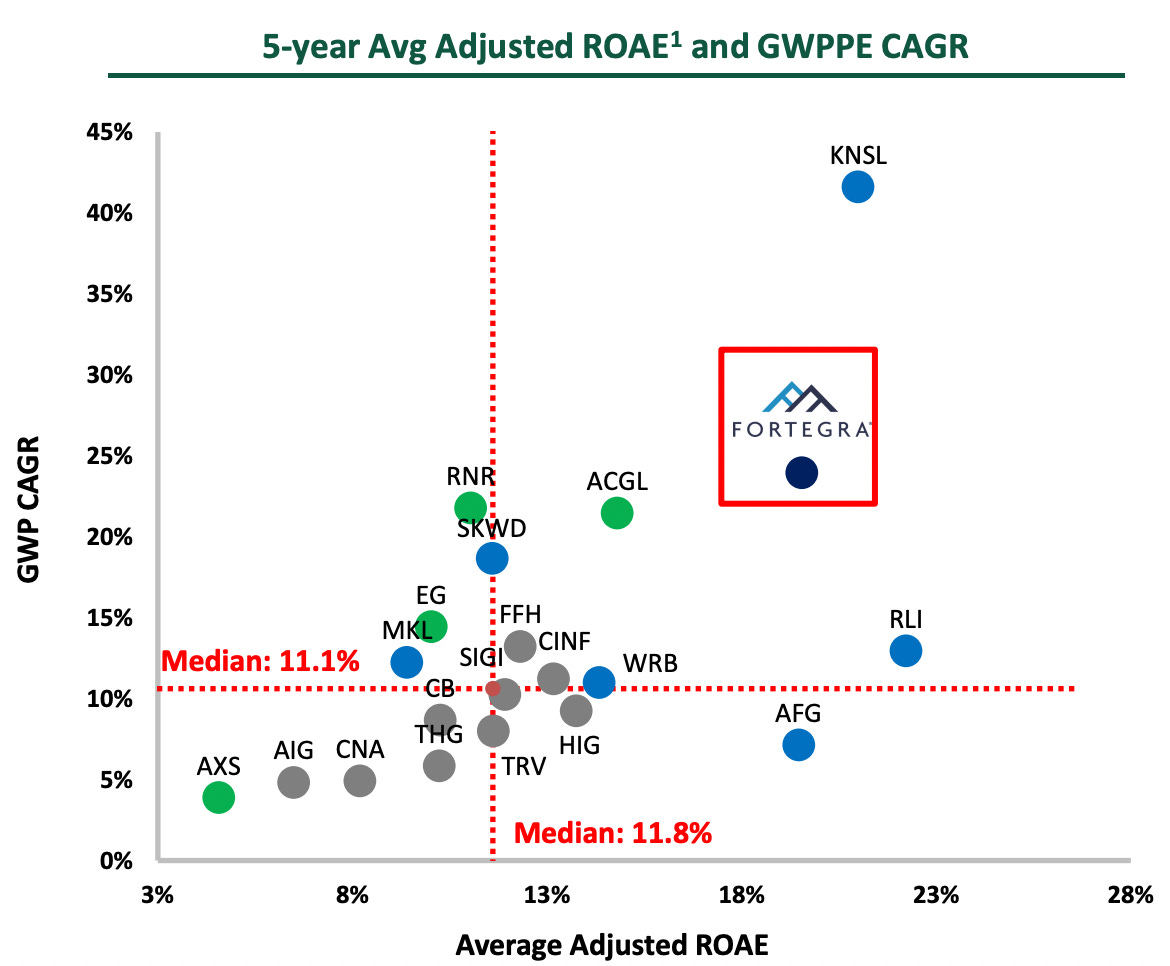

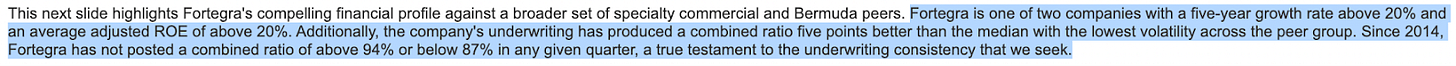

From a strategic acquirer’s perspective, this is a compelling company. There are immediately meaningful synergies, with about $30m of yearly corporate overhead (rent, operations, incentive plans) that would be retired, representing ~$4 of value per share. More importantly, it is a well-run business. The following shows that it is executing well compared to comps:

In a recent investor presentation, management highlighted Fortegra’s comparably strong performance over the past several years:

Risk Factors

Shares here represent good value, and, in my opinion, the risk is that you own an executing business that has good management, aligned stakeholders, and significant runway. However, if there is no strat-alts announcement, you likely trade mostly with the index. Additionally, if there is an announcement, the third time had better be the charm. Historically, there has been the risk of a sharp drop after failed attempts at liquidation events and I can only imagine the same would be the case. Beyond the specific earnings call catalyst, there are always risks in insurance, such as a blow-up of Fortegra before a sale is completed. Another risk for common investors is that management may not use the proceeds in a way in which you directly benefit, e.g. a special dividend. There’s a chance that they instead decide to acquire another company or companies, which may well be value-destructive.

Options carry much more risk, but you may be well compensated. Obviously there is a possibility that they expire worthless. However this name has had extremely low volatility and options clearly are not pricing in any major announcement. I have entered a position in the Mar 21 22.5 Calls. I was able to fill for 35C, and aim to sell on either a run-up into earnings or a reaction to confirmation of strategic alternatives. These calls are much higher recently, so the risk reward is diminished somewhat. Still, assuming the name trades up 25-30% in the month after earnings, these would do quite well. Assuming nothing happens around earnings, options might bleed a bit, but there will be no IV crush as IV is already so low.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered investment advice. Investing involves risk, including the potential loss of principal. The author holds a material position of the security discussed. The author may buy or sell at any time and without prior notice. The author is not a registered investment advisor and does not provide personalized investment advice. Always conduct your own research and consider your investment objectives and risk tolerance before making any investment decisions. The author and publisher shall not be liable for any actions taken based on the information provided in this article.

I really like TIPT, but I would be shocked if this sold for more than 15x EPS. 15x $150m = $2.25bn * 70% fully diluted ownership = $1.575bn to TIPT. This has zero tax basis, so 21% corporate tax burden would yield $1.244bn in cash to TIPT. IMHO, 100% of the value of TIPT is Fortegra. This would have at least a 20% holdco discount = $1bn valuation proforma for a divestiture at 15x EPS after tax after assuming a very modest 20% holdco discount. I've seen 30-40% holdco discount frequently in these types of situations. A 20% holdco discount implies a $27 PT. If Fortegra was sold for 12.5x, that would imply a $22.50 stock.

Where is the TIPT call happening? I don't see it anywhere