10x or Bust? Pure Play Fighting GLP-1 Side Effects ($IBIO)

iBio may have the best R/R in myostatin inhibition, but the market hasn't realized it is no longer a struggling immuno-oncology company.

Intro / Caveat Emptor

My recent articles focus on companies where you are unlikely to lose money, but may gain a significant amount. This is a company where you are likely to lose money, but may gain a very significant amount. The expected value formula has two variables after all. Over a series of properly weighted bets, the math is the same no matter which variable contributes to the product. Obviously the key is sizing.

This situation is not appropriate for 20% of your net worth. Perhaps you may consider 1%. But if you do put in 1% of your net worth, in several reasonable outcomes, it may become a sizable position.

With a $20m market cap and no debt, iBio is essentially a pure bet that a leading cardiometabolic team + aligned investors will be able to develop and partner on an attractive myostatin inhibition compound before 2026. There’s not really a need to do something like a DCF here—rather you should try to grade the team, review the technology, review the potential for success, and imagine various cases of monetary payout. These factors must be weighed against the cash timeline of ~1.5 years (given that a lack of progress might be a death knell). That’s what we’ll attempt to do here.

Trends and Subtrends

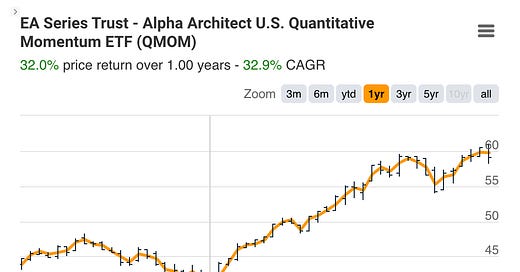

Before discussing iBio, it’s worth discussing the market’s recent trendiness—the primacy of momentum stocks. Momentum ETFs like QMOM are an easy proxy:

Two acronyms have contributed the most to momentum: AI and GLP-1. Interestingly these mega-trends both comprise and are reinforced by several sub-trends. Within AI, it is not just software companies that benefit but data centers, liquid coolant manufacturers, energy companies, etc.

The same will be increasingly true for GLP-1; we are in the early innings yet. Goldman estimates that GLP-1 will be a $130 billion/year market by 2030. Recently we have seen such demand that Wegovy and Mounjaro are officially undergoing a shortage. This has led to a sub-trend of DTC semaglutide compounds, which has bolstered companies like HIMS 0.00%↑ (though that’s another article). A less developed GLP-1 subtrend that is now seeing increasing focus is mitigating muscle wasting. Having reviewed the literature and talked to 5+ individuals who have taken semaglutide, two downsides emerge:

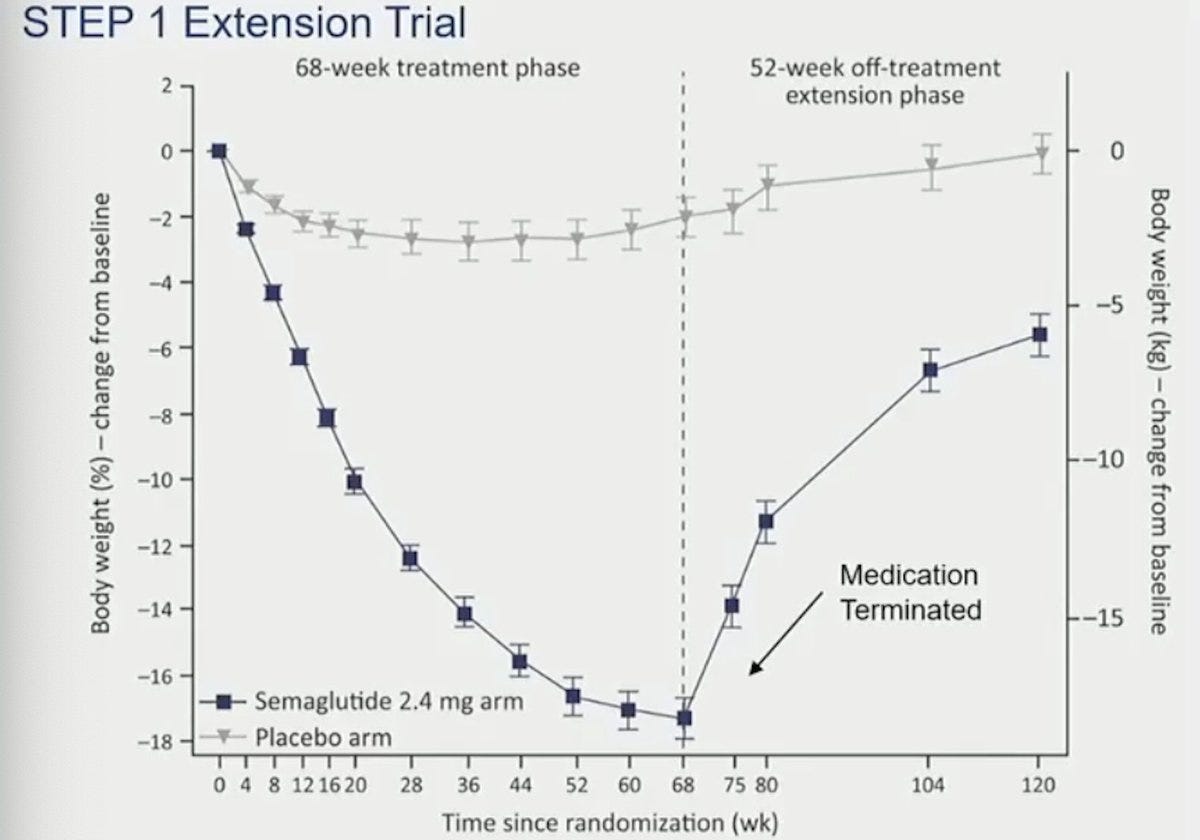

The weight will very likely come back on if you discontinue usage

It is very difficult to maintain muscle mass while on these drugs

Two images summarize these issues. First, in a study of nearly 2k adults taking semaglutide, we observe a startling bodyweight uptick post-termination:

Second, per reviews of major studies, some people’s weight loss is 40% muscle mass—which is a terrible outcome:

Taken together, these side effects mean that, if you start and then stop, you’ve not only regained much of the weight, but you’ve lost muscle. For some, like the elderly, this can actually be a worse position. This can be counteracted by weightlifting, but common sense tells us a majority will not incorporate these lifestyle changes. Which leaves room for another drug.

The sub-trend of cardiometabolic drugs which spare muscle while decreasing fat will grow increasingly strong as more and more articles come out around these side-effects. Companies which are reasonably priced bets on this should see substantial inflows mechanically until their opportunity is priced fairly (and this pricing may precede data from the actual bets on compounds themselves). iBio stands to benefit, and it has a rational focus on myostatin inhibition.

Myostatin

Myostatin is a protein that inhibits muscle growth. Evolutionarily, excess muscle is disadvantageous as it reduces speed and stamina. If you’ve seen a Belgian Blue, you have a good idea of what life-long myostatin inhibition does:

Myostatin can be inhibited through monoclonal antibodies. These compounds are metabolized over time, meaning they can be taken over the course of GLP-1 treatment (or potentially on their own). Eventually the body metabolizes them, so patients won’t end up permanently muscle-bound. Eli Lilly’s Bimagrumab shows real promise:

Gaining muscle while losing fat is an extremely impressive outcome. Given that these drugs objectively work—you will preserve muscle and lose weight—the obvious challenge is a treacherous regulatory approval pathway. Anything that can increase muscle growth will be looked at by the FDA with scrutiny. However, iBio does not necessarily need to worry about this as I’ll discuss later.

iBio Background

iBio is hairy. The company has destroyed a substantial amount of shareholder value over past years. It operated as a CDMO company for a while. Then, post-pandemic, it conducted several raises derived from hype around a doomed Covid-19 candidate. Its focus turned to immuno-oncology after the 2022 purchase of RubrYc Therapeutics’ AI Drug Discovery platform and pipeline. Per the 8-K the acquired assets include:

AI Drug Discovery Platform: A patented system that uses artificial intelligence (“AI”) to design 3D models of epitopes to facilitate the creation of better antibody drug candidates.

Previously Licensed Candidates: The rights to two molecules: IBIO-101, an IL-2 sparing anti-CD25 antibody for depletion of regulatory T cells, and “Target 6” discovered Q2 FY2022 using the Discovery Platform.

New Therapeutic Candidates: Three promising immuno-oncology (I/O) candidates, plus a partnership-ready PD-1 agonist for serious autoimmune diseases, such as systemic lupus erythematosus and multiple sclerosis.

The RubrYc acquisition was seen by the market positively and inspired a ~70% rally in the stock. Unfortunately, the development of these I/O candidates did not pan out, and in early March 2024, iBio appeared to be headed for bankruptcy. At the time burn rate was ~$30m against $4.3 million in liquid assets; a dilutive spiral was likely. The company also owned a large CDMO facility from its past life, but this appeared a tough asset to sell and was another overhang.

Private Placement and CDMO sale

iBio traded around ~$1 until March 27th, when a PIPE announcement spiked shares >300%. A large part of the move was attributable to the fact that the private placement valued iBio at a substantial premium to the market.

After the initial excitement, it became clear that the market didn’t agree with this deal; shares have traded to ~$2.35 at time of writing. This is too low in my view. First, it’s no longer the case that investors have to worry about much dilution in the near term:

“With the $15 million private placement we will have cash on hand to fund our partnership activities and operations through fiscal year 2025,” shared Dr. Brenner. “As with most biotech companies without a product on the market, we are not yet making a profit.” [Source]

Further, CEO Martin Brenner’s quoted timeline does not take into account a second positive development: iBio’s recent sale of its CDMO property to The Texas A&M Board of Regents for $8.5 million. Contained in the sale PR was an amendment relating to iBio’s $13m loan from Woodforest National Bank. The company will use the proceeds from the property sale to pay down the term loan, and the remaining loan balance will be covered by issuing a pre-funded warrant to Woodforest.

There’s a provision contained such that the bank is unlikely to exercise the warrant until iBio’s stock reaches $2.83, because the amount of shares they are entitled to assumes $2.83 (iBio book value) as the minimum divisor for repaying (via equity) the differential between the value of the CDMO building post-close and the value of the outstanding loan principal. By waiting until the stock is at least at $2.83, the bank could enjoy an extra ~$1 million. Regardless, the conversion of debt into equity is beneficial for a company running lean and burning cash.

AI, Drug Development, and iBio

“AI for drug discovery” is somewhat of an eye-roller. There’s been substantial hype but comparatively few concrete successes. However AI is not a monolith and there are specific areas within pharmaceuticals where it does better than others. One is lead optimization: the process of taking a compound which exhibits some desired behavior and tuning it for desired pharmacokinetic factors like solubility, absorption, and safety. AI tools here are a significant advantage. With regard to lead optimization, iBio’s CEO states:

“We've paired StableHu, a machine learning algorithm with advanced mammalian display technology, in order to significantly enhance the developability of our leads, enabling us to complete the lead optimization phase in under 4 weeks, which is much faster than the industry standard of 4 to 8 months.” [Source]

With companies like Pfizer and Eli Lilly having a head-start on monoclonal antibodies for myostatin inhibition, it is perfectly fine with me if iBio lets them discover much of the science and spend millions carving out a pathway with the FDA.

iBio can develop several candidates using its team’s expertise, wait to see the main safety concerns, regulatory challenges, or general deficiencies as revealed by Pfizer or Lilly’s drugs, and then optimize their candidates accordingly.

Still AI is just a wrench in the toolbox of scientists and researchers; ultimately the bet is on the team itself, not on technology. But as opposed to I/O, it makes sense that iBio would focus on myostatin. Dr. Brenner’s cardiometabolic background is notable and includes stints in the most relevant potential partners/acquirers:

Additionally, the PIPE brings in Astral Bio as a collaborator. Astral Bio’s founder, Patrick Crutcher, previously founded and sold Valenza, which focused on monoclonal antibodies. While terms weren’t directly disclosed, as far as I can tell this sale was for ~$500m based on the equity that was issued to fund the purchase. Not bad for a company which raised less than $100m:

Valuation

iBio clearly is trying to operate via a partnership model, not bring drugs to the market itself. Any level of significant success would result in a return of several times the company’s market cap—a solid compound would probably be valued in the hundreds of millions. In January 2023 Eli Lilly acquired Versanis, which owned bimagrumab, for up to $1.93 billion.

Returning to this paragraph from the introduction:

With a $20m market cap and no debt, iBio is essentially a pure bet that they will be able to develop and partner on an attractive compound before 2026. There’s not really a need to do something like a DCF here—rather you should try to grade the team, review the technology, review the potential for success, and imagine various cases of monetary payout. These factors must be weighed against the cash timeline of ~1.5 years (given that a lack of progress might be a death knell).

In my view, the team is hand-wavey A-/B+ (depends on Patrick’s level of involvement), the technology is an A (these drugs work), and the potential for success—while higher than for a random drug company—is inherently fairly low (maybe a C). But the monetary payout is an A++.

The market is clearly missing that the funds and individuals involved (ADAR1, Patrick Crutcher, Steve Brenner, etc.) likely have had strong insight into the company’s prospects—essentially “insider knowledge” that got them comfortable investing at a 20%+ premium to today’s price (Note: I am not saying this is shady—this is simply how PIPEs work AFAICT). It is telling that one of the leading practitioner/operators in cardiometabolics thought the R/R at iBio was worthwhile at a premium to current price.

Finally, having recently sold off a candidate immuno-oncology compound, it seems to me that RubrYc alone + the I/O pipeline would be worth something significant compared to a $20m market cap. That being said, this probably shouldn’t factor much into one’s analysis; it’s win or go home with this sort of bet.

How I’m Positioning

An interesting way to trade iBio is as a “levered” bet on Bimagrumab’s upcoming data. LLY 0.00%↑ is nearly an $800b company, so no matter how excellent the data, its stock shouldn’t move violently. However, if data are good, iBio will be significantly validated and may double from current levels. Everything so far points to strong data for bima, so this serves as “one bite at the cherry” for iBio, which will arrive well before 2026 and the prospect of dilution.

There’s a long/short here somewhere because in the event of poor data, the downside is not necessarily symmetrical. In a sense, bimagrumab’s failure would make iBio far more valuable, since Lilly would be looking for a new candidate. Keep in mind they already have a collaborative working relationship. That being said the market could just as easily punish iBio on a poor readout; the iBio “baby” may get tossed out with the bima bathwater. This is something I’d appreciate input on from biotech specialists.

In the interim, sub-trend momentum has begun:

As I have tweeted about, I would rather miss out on the initial 30% of a move, but buy when momentum has formed. After all, momentum works when the market has begun to figure something out. The perennial question is “is this formation period representative of momentum or just noise”? There are quantitative measures but it is often a case of “knowing when seeing”. With this sub-trend, I see it both qualitatively and empirically as someone with lots of familiarity around news alt-data e.g. stories from WSJ/Reuters/NYT, etc.

Finally, there’s a number of “call options” such as iBio’s I/O pipeline. They have also sold one pre-clinical I/O candidate already (with royalties up to $50m). I assign these zero value in my analysis but they are worth noting.

Conclusion

As discussed the iBio story is full of hair. From where it’s trading, the market either does not understand or does not appreciate that iBio is not an I/O failure but an emergent myostatin pure play. To me, that’s fine—it is the best publicly traded pure play on myostatin inhibitive monoclonal antibodies and that is worth substantially more than $20m in a world spending $130b/year market for GLP-1 drugs.

From a meta perspective, the ability to speculate directly on this sub-trend is also worth more to investors than $20m. For this reason alone I’d expect inflows to continue. Additionally if you want to “hedge” on any one GLP-1 beneficiary, investing in a company searching for next gen medications is not the worst idea. As we wait for bima data, we will potentially enjoy inflows as more and more investors figure out that the cardiometabolic iBio of today is not the I/O iBio of yesteryear. When bima data arrives, we may be handsomely rewarded, and some of the risk of poor data can be hedged. And if iBio succeeds on its own, a 1% position may become a large position.

That being said, don’t forget the probability side of the EV equation—this is biotech, so you’ll have to be ok with probably losing your money.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered investment advice. Investing involves risk, including the potential loss of principal. The author holds a material position of the security discussed. The author is not a registered investment advisor and does not provide personalized investment advice. Always conduct your own research and consider your investment objectives and risk tolerance before making any investment decisions. The author and publisher shall not be liable for any actions taken based on the information provided in this article.

I have no idea if this post is valid, but does it change your opinion at all?: https://x.com/mohammedalo/status/1797722870363173332?s=46&t=5QVogoNEzaXWjYF3KltY6Q

Great call. In the near term, do you view the bima data as more material to IBIO or apitogromab?