AI Radiology Company Transitioning to Cloud w/ Multibagger Potential ($ICAD)

The market values iCAD's business operations at zero, but the company can become cash flow positive and triple revenues without any new customers.

Company Overview

iCad is a provider of CAD (computer aided detection) and AI interpretation for mammography. The company has been the technological leader in this niche for 20 years. The stock has oscillated as the industry has transitioned from film to 2D imaging to 3D (and now AI-aided) imaging. In such a dynamic industry the company’s positioning has at times allowed it to grow revenues rapidly, and at times hindered growth.

Currently the stock is at multi-decade lows. However the future is bright. The industry is again evolving due to an ongoing radiologist shortage, advances in AI, and favorable legislative and market sector changes. iCAD’s management has finally been executing and the company is positioned to reemerge as an industry leader.

The fundamental idea behind this thesis is that iCAD is erroneously considered a medical device company. By converting even a fraction of current customers to cloud subscriptions—a change which actually aligns with customer incentives—the company will transition into a SAAS story. This transition is already ongoing, and can potentially generate an additional >$30m in ARR (again simply converting current customers). The company is near operational breakeven, and new revenues should come with similarly high (85%+) margins as the company’s current revenues.

If the transition is slower than expected, investors are protected by strong net cash balance as the company reaches operational breakeven: backing out working capital and net cash, the market currently values the company’s business operations, customer relationships, future potential, and technology at a negative value.

Breast Cancer Mammography / Radiology

Mammography is far from a “solved” problem. Around 20-40% of cancers are missed in screenings. Partially because of this, nearly 60% of women no-show their recommended annual imaging appointments. This is extremely concerning—despite treatment advances, breast cancer prognosis is grim at later stages:

Additionally, incidence rates are actually increasing. This is likely due to microplastic exposure and cosmetics use. These trends result in drastic costs to society, families, insurance companies, and taxpayers:

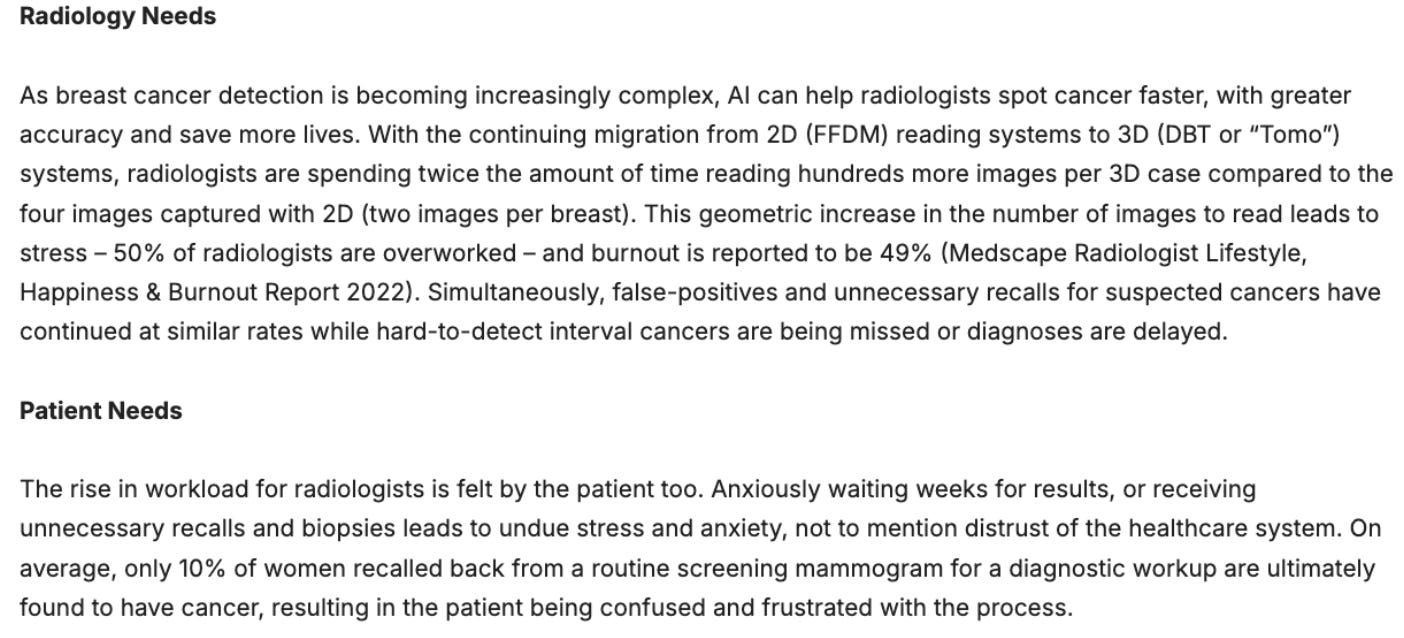

Compounding the issue, the radiology industry is undergoing intense industry pressures leading to slow feedback times and massive provider burnout. The reasons for this are both supply and demand driven. On the supply side, there are fewer and fewer radiologists:

Although this is mostly unfounded—as discussed later —there is a perception that radiology will be made obsolete by AI

There has been broad burnout as a result of Covid-19; many radiologists accelerated their retirement

Due to federal funding restraints, growth in specialist physicians has grown disproportionately faster than growth in radiologists

On the demand side:

Cancer is now often a chronic condition—the fact that cancer patients are living longer means that continual and repeated imaging is necessary

Far more patients are demanding imaging at earlier ages due to messaging about the importance of screening

Full-body MRIs are increasingly in high demand, further burdening the system

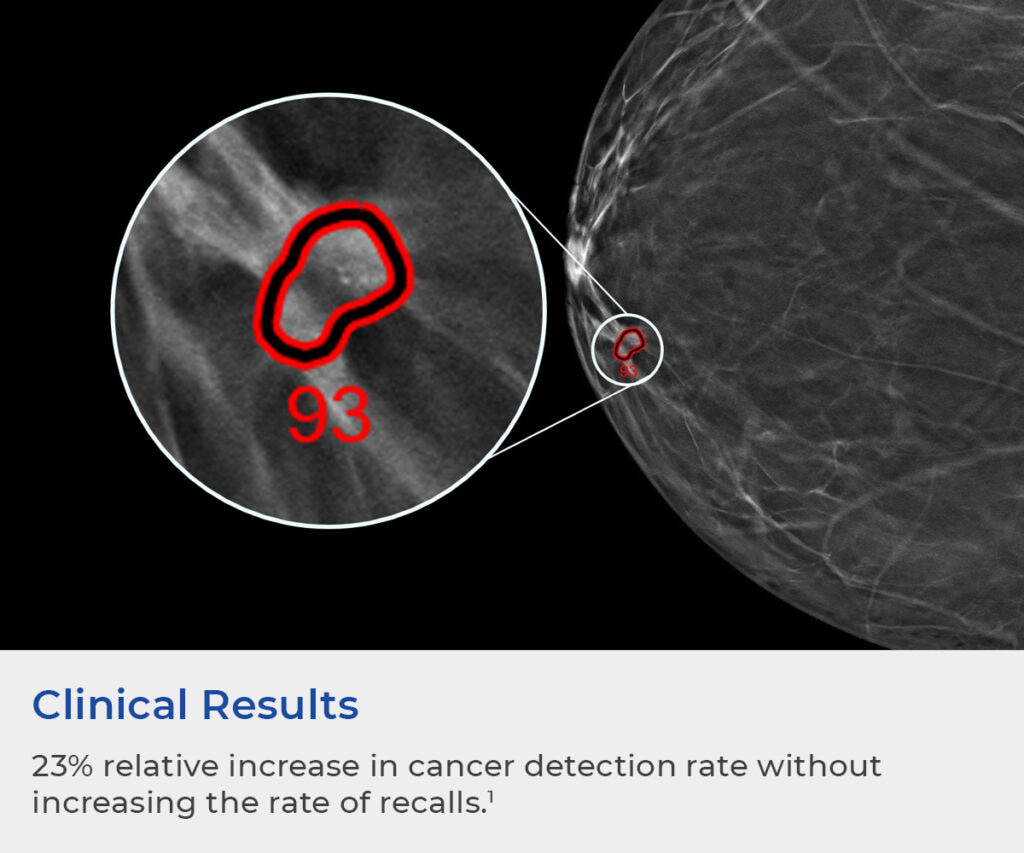

iCAD’s FDA approved software helps radiologist read mammograms 2x as a fast, while detecting 23% more cancers. The company’s suite is currently used in around 50% of the AI-enabled exams taking place. From their 10-K:

Technological Positioning vs. Competitors

iCad’s main product is its ProfoundAI Breast Health suite, essentially a series of algorithms developed from a massive database of human-labeled radiological exams. iCAD has built this product up by training it on 6 million images from 100+ global centers. ProfoundAI has four main components:

Cancer Detection

Identifies cancer with a 23% improvement in sensitivity

Reduced radiologist reading time by ~50%

FDA cleared, CE marked, and Health Canada Licensed

PowerLook Density Assessment

Categorizes breast density into 1 of 5 segments allowing for personalized screening plans

Highest accuracy on market

Breast density assessment required as part of mammography from September 10th, 2024 onwards

FDA cleared, CE marked, and Health Canada Licensed

Risk Evaluation

Prognostic tool to provide risk assessment for 1-2 year time horizon based on scans today

CE marked Health Canada Licensed, currently submitted for De Novo approval by the FDA

Heart Health

Uses mammogram imaging to identify arterial classification in the heart

Working through regulatory approval pathways

The headline is iCAD is leading the market in the two most important areas—cancer identification and density screening—with cleared products that are increasingly necessary.

The general online consensus is that the Profound AI suite is best-in-class, years ahead of Hologic and other competitors’ products. iCAD has numerous high-profile partnerships (Google, NVIDIA, Cleveland Clinic, GE Healthcare, etc.) that speak to this point. One can also examine the scientific discussions/presentations here, here, and in the company’s September investor presentation. There was also a strong reaction (albeit a short-lived one) to data presented at the European Congress of Radiology:

It should be noted that, per expert calls, GE Healthcare (which uses iCAD) and Hologic are really the only two companies making the DBT machines conducting breast imaging. Other competitors are much smaller and are private. This can predominately be thought of as a two-player market, with iCAD is the leading player in head to head tests, and partnered with GEHC.

How can iCAD have better software than the much larger Hologic? Hologic is a broad, $18b women’s health corporation, with mammography AI/CAD being only a small sub-focus. Consider this from an expert call years back:

However, it Hologic does have one advantage: they have produced 69% of installed mammography units. iCAD’s software is compatible with their machines, and is already used on many of them, but Hologic has leverage given that it can complicate go-get revenue for iCAD on their machines. Of course, Hologic is a natural acquirer for iCAD, as discussed later.

Strategic Evolution to Present

iCAD has a long history and has evolved with the mammography industry. For the purposes of this writeup, it’s worthwhile to look back to 2018. At the time, iCAD had an additional division: a medical device company called Xoft. Xoft founder Michael Klein had become the iCAD CEO. Klein had earlier joined the iCAD board when Xoft was acquired.

The idea was to grow through vertical integration. Xoft developed a brachytherapy product, which allowed targeted radiation treatment to begin earlier than would be typical in the event cancer was found. The “vision” was that radiologists would use iCAD, efficiently detect cancer, and then involve oncologists via Xoft’s tech. In theory this was a reasonable though optimistic and operationally complex plan. In practice the company moved too aggressively, doubling the salesforce before proving out demand.

Increasing revenues—in part driven by Covid-19 froth and hype around Xoft’s products being used to treat a brain tumor—saw the stock reach highs. The company was a perfect “Covid stock”: med-tech, in an exciting area, and, especially compared to other small caps, well-funded. Despite potential the company was never actually able to convert this excitement into operating cash flow. Further, due to the bloated salesforce, even as revenues grew from $25m to $33m, there was margin erosion from ~80% gross margin in FYE ‘19 to 73% in FYE ‘21.

Management was smart and opportunistic, and began raising a large amount of capital including a $22m raise in March ‘21. The raise was quickly absorbed by the market. Eventually, though, fundamentals came to matter. A series of underwhelming results during H2 ‘21 saw the stock decline from highs of $19 to the $6-9 range.

It seems this was largely driven by the Covid reality—it was difficult to sell to hospitals on integrating Xoft and iCAD when they were dealing with much bigger issues. It’s important to keep in mind that, during this period, iCAD was mostly selling a computer loaded with its software that could interpret radiographic images. Many times these were sold with perpetual licenses for, say, $30k. iCAD would still continue to generate service revenues, which were substantial, even reaching 40% of all revenues. Still, it was not exactly operating as a recurring revenue business.

One positive from this time was progress on the AI side. ProfoundAI received FDA approval years before competitors’ products (e.g. Hologic), giving them a multi-year first-mover and tech advantage which persists to this day:

As revenues were increasingly unpredictable and in decline, the stock sold off. Klein was let go as CEO, though he remained on the board. A long time employee, Stacey Stevens, stepped in. But then the Fed began raising rates and capital further flowed out of small cap med-tech stocks. The final blow was this rather unique disclosure; it seems the management team was completely misaligned over the future direction of the company:

Dana Brown, a former SVP at Susan G. Komen, was brought in with some contention. Investors—and board—members threw in the towel.

A New iCAD?

Dana Brown has an interesting industry background. In 1992 she co-founded MetaSolv software, a “provider of software designed to aid emerging telecommunications service providers with their customer services needs”. She grew MetaSolv from 3 to over 800 employees and was with company up until its 2002 IPO. She worked as an executive at a variety of companies after this, and, before iCAD, was an SVP and Chief Strategy Officer at Susan G. Komen. My sense of Dana is that she is fundamentally a strategic thinker: she wants to come into a company with an operational game plan, execute it, improve results, and then either sell the company or move on. Management has laid out a 3 step plan for iCAD. This slide summarizes progress thus far:

After essentially completing Phases 1 and 2, the company has gotten burn under control and narrowed its focus by divesting Xoft. What might Phase 3 mean financially?

Phase 3

Shift to Cloud

In Phase three, the company is turning away from selling perpetual licenses (priced around $30-40k). These involve a laptop that runs ProfoundAI, along with recurring servicing contracts that bring in ~$8k/year per unit. Current customers are essentially paying this price. iCAD is now leaning into cloud based / subscription agreements, which bring in ~$12k/year/contract backing in from recent disclosures. Generally, it makes more sense for cash sensitive hospital/screening/outpatient systems to pay the marginal $4k per year without the large upfront cost to enjoy continual software improvements and avoid dealing with troubleshooting physical machines.

The table below summarizes progress so far:

The company currently has 2,500 installed perpetual units. This represents ~$300m of additional LTV which the company can pursue without adding new customers. As shown above, progress has been impressive so far; cloud has launched only in Q2 and already has 10 customers, representing $1.2m in future billings (the company seems to assume $120k in LTV or $12k/year). However it is early days.

Market Expansion / Channel Growth

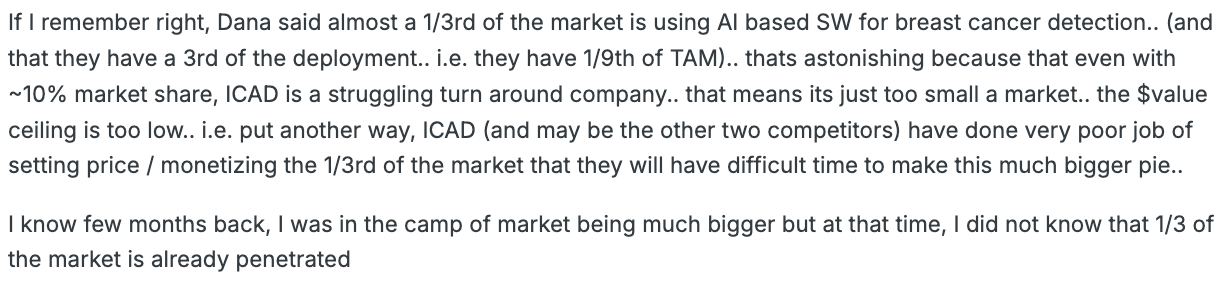

The company is only involved in 1/9th of total yearly U.S. mammography exams. Their software is used in 46% of all AI-augmented exams, but these represent just 37% of total exams. Consider the following summarized 2022 interview with an SVP at a radiology services provider which addresses AI saturation (or lack thereof):

However one comment seems particularly striking:

“When 3D mammograms came out, tomograms, there was no code for that either, and we charged patients, and patients paid for it. And it's the same analogy that they're paying for that confidence. If I was a woman and I had to pay for it, knowing what I know, 100%, I would pay for it. Because it definitely finds cancers that we miss. It's been documented to show that it finds cancers that the radiologists missed and finds them earlier. So they have two programs for their mammography. One is the radiologist who is reading the study looks at it, and then there's a second look for certain studies with the AI. So a certain percentage of mammograms will go to a second radiologist for a tie-breaker opinion."

There is some subjectivity about how quickly AI will continue to be utilized. Personally I am of the belief that within 5-10 years, all US exams will use or even require AI. Generally (as we’ve seen with the startling progress of ChatGPT) people underestimate how quickly AI models can improve over time. Even without improvements, current models will be ever more necessary to address the challenges faced by the radiology industry.

iCAD has partnerships with OEMs like GEHC, Google Health, Radiology Partners, Change Healthcare, and Solis. Through these partnerships, it hopes to expand the number of iCAD enabled sockets: “In 2024, iCAD plans to introduce more options including an iCAD cloud environment and additional hosting options through strategic partnerships.” These partnerships help level the playing field with Hologic. The mammography market in general is expected to grow at an 8.9% CAGR through 2030, and these partnerships should help iCAD capture this growth.

Finally, one thing to note is that there is a chance that a CPT code comes out for 3D tomography scans with AI. This would be an industry-changing development that would be extremely bullish for iCAD and would likely result in complete AI saturation in less than 3 years, as radiologists would essentially get better results and get paid, say, $30, to click a button at the end of an exam.

Entering New Markets

There is a large global market—approximately equal to the size of the U.S. market by spend—in which iCAD has a foothold. Currently ~13% of revenues are from Europe and other non-US countries. The most exciting development for iCAD in this space is its 20-year partnership agreement w/ Google. This agreement focuses on 2D scans, which are still the global standard due to cost. While not a meaningful revenue generator for iCAD currently, it’s worth watching how this partnership develops.

Legislative and Industry Tailwinds

On September 10th, new density assessments became required for breast scans; breast density is predictive of developing cancer. Now, reports must include a density asssesment. The challenge is that density is not universally defined, causing large variance in classification between radiologists. iCAD has an FDA approved density product as discussed earlier. These guidelines should make iCAD’s software suite marginally more valuable to radiologists.

Secondly, new guidelines recently were released advocating for earlier breast screenings. It should be noted that these were released last May, seemingly causing a temporary 150% run-up in the stock.

Certainly the largest potential legislative change would be a CPT code for AI assisted 3D mammography. Per expert conversations, this would likely see nearly 100% of market penetration within 3 years, since radiologists would essentially be able to make more money simply by pressing a button, while improving outcomes. It should be noted that when a CPT code was released for 2D scans many years ago, it was near-universally adopted. This was hugely beneficial for iCAD. For example, in 2008, the company generated $13m in free cash flow, and traded at $19.8/share.

Finally, it’s worth noting that the potential election of a female president, and a president focused on women’s health issues, may be seen as a positive. Kamala Harris’s mother was a breast cancer researcher. It would not surprise me to see lobbying from larger companies like Hologic for a CPT code, depending on what happens in November.

Valuation

Currently, the company is generating around $5m in quarterly revenues. Breakeven should occur around $6m/q, which will likely be achieved within 1 year. It’s important to note that the company has net cash of $20m. Management has explicitly said in its recent presentation that there is “no need to raise additional funding to pursue current growth initiatives.” There is an S-1, but it would be counterproductive and foolish to raise at these levels.

Given the story is one of transitioning to stable, recurring revenues, it seems reasonable to value the company based on an ARR multiple. Further supporting this is their commentary on the last call that “our number one most important metric is ARR”. The following numbers summarizes revenues and profitability:

Given how much progress they can make by doing “simple” things like converting current customers and reconnecting with ~1000 customers who have lapsed on their maintenance agreements or who are utilizing antiquated software.

Despite having worse technology and market penetration, Volpara Health ($VHT.AX) was acquired for ~8x revenues in December 2023. Similarly, Radnet’s AI segment apparently was acquired for 7-10x revenues. For iCAD, let’s say ARR growth continues at 30% YoY for the next three years, and the company reaches operational breakeven. At an in-line 8x multiple, the stock would be a 5-bagger. This sounds aggressive, but actually might be conservative considering it is completely overlooking non-recurring revenues, global growth, net cash, etc. There are natural acquirers like Hologic, Radnet, or Lunit.

None of this includes the potential for go-get U.S. revenues. It’s hard to say how successful iCAD will be, but it’s worth noting that RadNet is trying to convert some clinics not currently using AI via its EBCD breast health suite. It is amusing to see RDNT 0.00%↑ stock having performed so well in large part due to this AI narrative, despite the company being further behind in the space than iCAD (e.g., they lack an OEM partner).

Risk Factors

It’s odd to me, given the above, that management haven’t bought shares recently, or even initiated a buyback. However, board member Andy Sassine (the CFO of Arcturus Therapeutics) did add 50,000 shares in Q2 to bring his holdings up to ~5% of the company.

This comment from MCC speaks to another risk:

This comment speaks to a valid point. However, while TAM isn’t massive, iCAD isn’t collecting anywhere near 1/9th of the actual TAM. That’s because they haven’t utilized subscription/cloud based pricing, added on additional diagnostic/workflow tools, etc. Once again, they’ve mostly pursued perpetual licenses. Additionally, this overlooks opportunities in 2D, global revenues, 9% mammography CAGR, etc. However, there is a risk that the market perceives the TAM to be too small and refuses to give iCAD credit. There is also a risk that, with Hologic’s installed base, the market is smaller than it appears. iCAD’s management team needs to be more clear about how they think about realistic TAM and clarify the above comments.

Again, despite partnerships with the other major players like GEHC, the market for units is still dominated by Hologic. Over 75% of units are made by Hologic (mathematically implying that iCAD is clearly used on some Hologic machines). However, Hologic may make adoption difficult on its machines for iCAD, meaning the remaining 2/3rds of the market which is completely un-penetrated may not be easy to capture.

Perhaps the biggest risk is management. Though management has been executing there have been historical issues with the board. It seems the board has been involved in missteps in the past, such as the focus on Xoft. While the C-suite has changed since the Xoft days, the board has largely remained the same. The team will have to continue performing to win back the trust of the market.

Why is iCAD cheap / given no credit?

iCAD screens as an unprofitable medical device company, though it is transitioning to a SAAS company

Revenues dropped around $12m with the sale of the unproductive Xoft segment, which, at first pass, made it seem as if the company lost a major client, etc.

Mismanagement, as has been alluded, is not necessarily trusted given the recent past

Most of all, there is the misconception that, as a small company against well capitalized competitors like Hologic and Radnet, iCAD will not be able to compete in the space

Catalysts

There is a major and impactful radiology conference in early December where iCAD will present. This is also historically an excellent period for the stock, with 30%-40% moves over the December-January period in 4 of the last 5 years.

Continual proving out of management strategy with an eye towards positioning the company for an eventual acquisition

It would be very reassuring for the market to see more insider buying at these levels; without it, there is a sense that management is not excited about the company (as it is, optically, extremely cheap).

____________________________________________________________________________

Disclaimer: The information provided in this article is for informational purposes only and should not be considered investment advice. Investing involves risk, including the potential loss of principal. The author holds a material position of the security discussed. The author may buy/sell at any time without notice. The author is not a registered investment advisor and does not provide personalized investment advice. Always conduct your own research and consider your investment objectives and risk tolerance before making any investment decisions. The author and publisher shall not be liable for any actions taken based on the information provided in this article.

I largely agree with your views here. As an example, my sister in law (this is ten years ago) didn't accept a mammogram's results, knowing that she was high density but "feeling something", re-tested and was confirmed early stage BRCA+ trip neg.........her intuition saved her live, I spoke with her yesterday after a routine follow up scan (clear).

So the density issue, while seemingly underrated by the market is HUGELY overlooked IMO. Similarly, but yet to be proven, in the cardio space.

That being said, $ICAD is an underdog despite advanced tech, and that "advanced tech" moat is subject to erosion via AI (and time). 12 -24 months is my window for increased market share and/or a buy out.

Thanks for the write up, well done! Long ICAD

Hi Mike - Im a radiologist and own about 2% of ICAD. happy to chat If you would like. thanks for bringing attention to this name.